For all the articles on how to raise funding, timing comes up a lot less often. Yet, the question of when to raise is arguably just as — if not more important — than the question of how. It is also more of an art than a science. At Madrona we mostly invest very early in a company’s lifecycle – at the seed and A stage. And we usually start talking to companies well before the stage they are approaching.

(If you are later stage and reading this – check out our Acceleration Fund here )

Sometimes this is a quick decision: product, team, and market are in alignment, but sometimes those pieces aren’t enough in alignment to give us confidence that the funds entrusted to us by our investors should be invested at that moment in the company’s lifecycle. If there are elements we really like such as the team, we continue to work with the entrepreneur and be helpful where we can with intros and advice. Sometimes not raising at that moment in time was a good decision for everyone involved.

A great example from the last couple of years of a company that benefited from NOT raising early is Unearth. The company’s founders initially came to us very early in their life cycle — about a year prior to when we actually funded them. Venture is not about just financing but involves a strong partnership around company building and scaling and at its core is a relationship business. The investors you choose will be with you throughout your journey – at least if you work with Madrona, they will be – so you want to choose wisely.

And that’s how we started with founder, Brian Saab. We have had a working relationship with Brian for over a decade. Brian and Soma worked together at Microsoft. Brian had been a co-founder at another startup where we worked with him called buuteeq, which was acquired by Priceline back in 2014.

According to Brian: “Our early idea was very focused on how to use drones in a new way to map. We went to Madrona while we were doing a friends and family raise around this idea. At that point there were a lot of open questions. We had good conversations with Tim and Soma, but they didn’t think the business was ready for VC funding yet. Not raising from Madrona led to more discipline around the business as I dove into pulling the angel round together, which I liken to herding angel cats. This smaller round kept us capital efficient and we didn’t overbuild during the early time period.

“Not raising from Madrona led to more discipline around the business as I dove into pulling the angel round together, which I liken to herding angel cats.”

As we progressed, we kept Madrona apprised of where we were throughout the whole process of market and customer exploration. We had started with a focus on drones and IOT and had chosen the construction sector, but we were still mostly focused on using drones versus creating the platform of work management we have today. We went back to Madrona as we went to market with a deeper product for construction and at first Madrona didn’t want to lead but then they got closer to the business and saw what was happening at a deeper level. Soma pulled in senior associate, Chris Picardo, and then they led the seed round of $4.5 million. And today our business is strong – we have expanded our focus and it’s great to have Soma and the team supporting our journey.

Unearth raised a Series A of $7 million following a successful seed stage.

Why Timing is Important

As Unearth shows, there can be real costs for miscalculating timing of your first institutional round. Raise too early and you could put yourself ahead of what your company can feasibly accomplish. This can put a huge amount of unnecessary pressure on you and your team to live up to the raise. The pressure can lead to unwise spending, high burn and a cash out date that arrives before achieving the milestones you set in place when you raised the round.

Conversely, if you bootstrap for too long, beyond the obvious (running out of money) you could allow competitors to outpace you and miss the ideal window for scaling your business. Keep in mind the fundraising process takes time. Be sure to mentally prepare yourself to devote at least a 3-6 months to the process, potentially more.

Determining the Right Time for Your Company

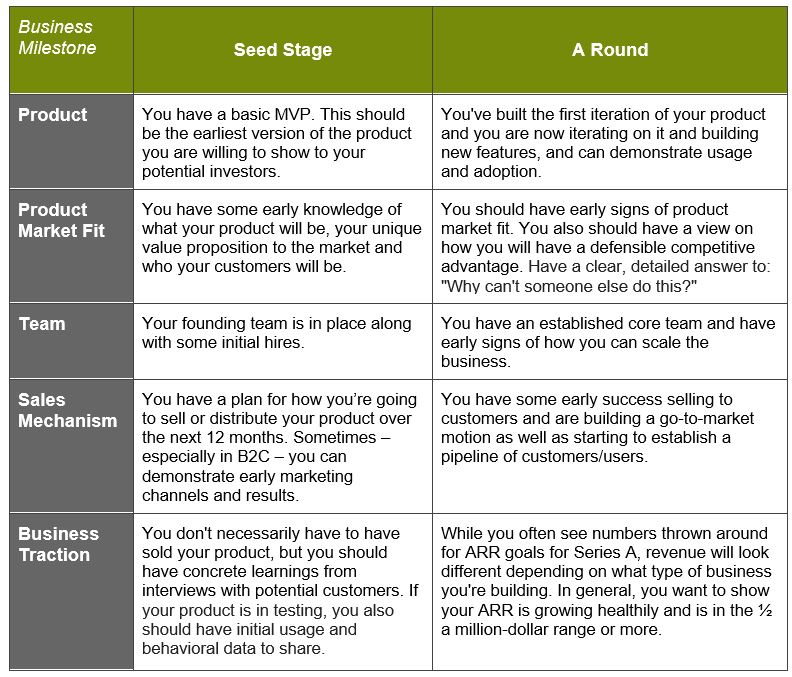

A good rule of thumb is to start fundraising when you have six months of cash left. While every company is different, here’s a general guide for where your business should be by then so you’re well-positioned for early-stage financing:

We (and Pitchbook) took a look at data of technology companies that raised a series A in the past 5 years in the US and found that on average companies close seed rounds 1 year and 9.6 months after their founding date and A rounds after 1 year and 10.5 months after their seed financing. However, these are just averages and every business is unique. What’s most important is you are keeping an eye on your cash balance and have a clear vision of what milestones you want to reach before hitting the market.

On a final note since we’re talking timing, contrary to what some people say about VCs and the summer and winter holidays there is never a wrong time of the year to raise! We can’t remember a year in recent memory where we weren’t closing a deal in August or over the winter holidays, for instance.

If you have a great idea, come see us! It’s never too early to talk!

Chris Picardo greatly contributed to this post.