Are you an angel investor or interested in becoming one? Please join Madrona on the evening of June 14th at Madrona’s office to network and hear a conversation with other Web3 angel investors and operators. They will talk about ways to approach investing in this high-growth space and the pros and cons of Web3 business models. If you would like to attend, please email [email protected] for an invite link.

Madrona recently surveyed more than 80 PNW angel investors to better understand some of the challenges angel investors face. One challenge that stood out was that while organizations like the Alliance of Angels are great for bringing angels together, we found that angels and founders struggle to find each other. For that reason, we are excited to introduce an open directory of PNW angel investors. The directory includes areas of interest and contact information, and we hope it will be a resource for founders to find angel investors that fit their needs.

If you are an accredited angel investor and would like to be added to Madrona’s angel investor directory, please submit your information here.

We recently conducted our 2022 annual angel investor survey. The overall tone of the feedback we received this year was energetic, curious, and constructive. The data shows that the angel community has continued to grow as the startup community has grown, and the number of companies being built in Seattle has increased. It also showed angels often invest alone but that many angels prefer to invest with a group. We also noted extreme interest in Web3 and curiosity about the sector.

Key highlights:

- PNW angels have become more active: 39% of survey respondents made at least five angel investments in the past 12 months – a significant increase from our survey last year, which was closer to 30%. 90% of angels made at least one angel investment during the past year, and close to 15% made eight or more investments.

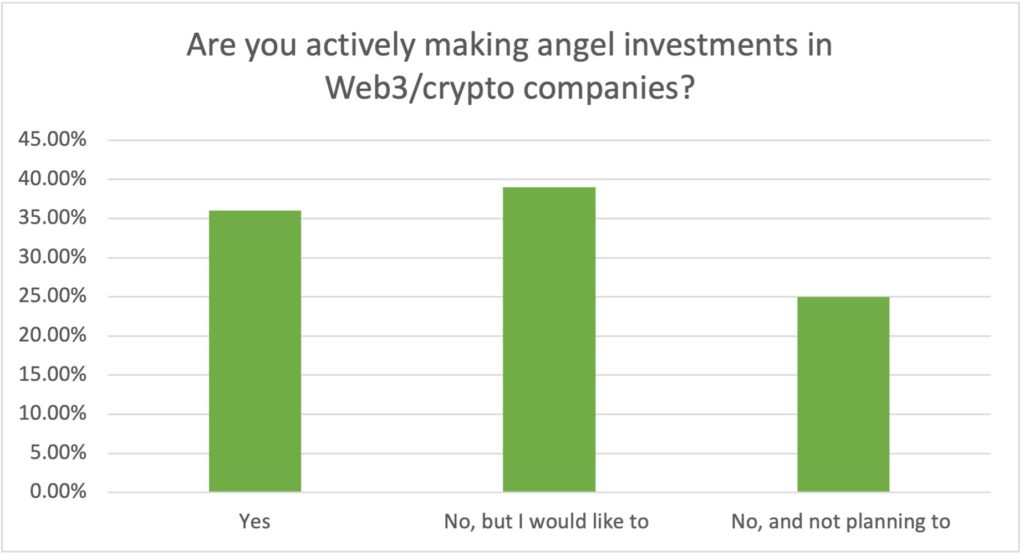

- Web3 has become a topic of interest among the angel community: 36% of respondents made at least one angel investment in a Web3 or crypto startup in the past year, while 39% of respondents have not yet invested in the space but said they would like to make at least one Web3 investment in the next few months. Only 25% of respondents are uninterested in investing in Web3. Although some angels are not interested from an investment perspective, many of them noted that they are still extremely interested in learning about Web3.

- More startup activity in the Pacific Northwest: Many Seattle angels responded that the ecosystem has “gotten busier” with “more deals at higher valuations.” Over the last 12 months, more startups have raised money, and we’ve seen an increase in valuations and the number of micro-VCs. Valuations are taking a pause on that growth at the moment, and we look forward to next year’s responses to judge how angels are reacting.

Improving Access to Deals

Angel investors continue to want increased access to deals and education about investing – a sentiment reflected in our survey from last year. An increasing number of employees at tech companies are accredited and qualified to invest, but they may not know how to conduct the proper due diligence of companies, or they may not see enough deals to make educated, quick, decisions about whether to invest. A common thread across the survey this year and last year was that angels want increased access to deal flow, and we hope the new directory will assist with this. Angels noted that they appreciate the increasing number of founder/investor events hosted by super angels and micro-VCs such as Kirby Winfield of Ascend.vc, which has helped them increase their access to founders. The top three things that angels noted would increase their number of investments in PNW startups remain the following:

-

- More collaboration with institutional VCs.

- More opportunities to meet founders.

- More access to low-cost funding rounds.

Are you an angel investor or interested in becoming one? Please join Madrona for a conversation on the evening of June 14th at Madrona’s offices to meet other angels and hear a conversation with Web3 angels and operators. They will talk about ways to approach investing in this high-growth space and the pros and cons of Web3 business models. If you would like to attend the event, please email [email protected] for an invite link.

Thank you to all angel investors in the Pacific Northwest. Your work is core to the technology ecosystem, and we look forward to working with you now and into the future.