Madrona held a webinar for angel investors and angel curious investors in June of 2021. Hosted by S. Somasegar and Ishani Ummat, the conversation was engaging with Kirby Winfield of Ascend.vc, Yoko Okana of First Row Partners and Sharad Agarwal of Grubstakes, an angel network, talking about everything from valuations to deal flow. Though touching on the data below, the discussion added color to the experience of investing, meeting companies and other investors and current trends. The link to the full replay of the discussion is here.

Over the past year and a half, the broader venture ecosystem has changed significantly. 2020 brought a record amount of capital deployed – to the tune of 5x increase over the last decade at about $150B. We’ve experienced a faster deal pace, and a higher velocity of investments overall. This success is translating to break out companies in our local Pacific NW ecosystem, with 10+ fast-growing unicorns as of December 2020.

One thing that hasn’t changed fundamentally is that angel investing continues to remain a bedrock of the tech ecosystem. While a small slice of total investment dollars, angels often play key roles in the company’s development that goes far beyond that capital allocation.

One particular example is Outreach – just last week, Manny Medina’s company raised $200M at a $4.4B valuation, joining the likes of Convoy, Qumulo, Remitly and others. Outreach was founded in 2011, and angel investors, including Sarah Imbach, were a core part of their first couple of funding rounds. Sarah is a prolific angel investor and had been advising startups for a number of years before investing in Outreach. She subsequently joined the Board of the company and has been deeply involved over the years. Manny credits her with bringing a lot of incredibly valuable operational experience and advice to the table.

This story is not unique – Highspot raised early money entirely from angel investors before Madrona came in and led the Seed round. OfferUp is another canonical local example, alongside iCertis, Auth0 and countless others who tell strong stories of angel investor involvement from the early stages and for the long run.

Here in the Pacific Northwest, we know that the angel community and investment dollars have grown over time: in 2020 alone, 61 groups and 298 individual angels participated in over 200 deals that raised a total of $1.4B1. (1 Pitchbook)

This year, Madrona surveyed 115 local angels to take a deeper dive into what’s going on in the Seattle angel community. We wanted to hear from the angel investor point of view and to better understand their perspective on the environment. How active is the Seattle angel community? What is going well? How do we continue that momentum? What steps can be taken to improve? What role can institutions play to help facilitate that? Thank you to all the angels that participated in our survey – we’re excited to share the results with you today.

The overall tone of the feedback we received was optimistic and constructive. The data shows that as angel investments in the Pacific NW have increased over time, the community has also grown, and there are emerging resources and opportunities to help angel investors both individually and as part of popular local groups like Kieretsu, TiE Seattle, Alliance of Angels, E8, Grubstakes and more. We also heard some constructive feedback on areas this community must improve – encouragement for new angels to participate, agile and efficient evaluation of deals, and increased deal sharing and flow across communities.

Key highlights:

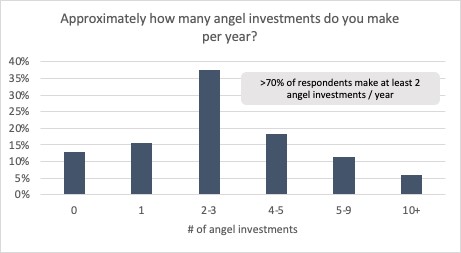

- Local Angels are active: Over 70% of survey respondents make at least 2 angel investments per year. A majority of that group are making 2-3 investments / year, there is a strong cohort of angels making >4 investments per year.

- This community is collaborative: While 36% of angels operate individually in Seattle, the remaining majority invest at least in some capacity with local angel groups. This collaboration is also an important source of deal flow. The majority of angels we surveyed (80%+) meet founders they invest in via referral from other angel investors or angel groups. With lots of groups, this is generally well-perceived but there’s always room for more. As one respondent put it, “Collaboration has been pretty good over time (e.g. Madrona’s meet-ups going back years now) but there could always be more visits, more deal sharing, more communication, etc.”

- Angels are helpful: Behind collaboration, one of the top descriptions of the Seattle angel community was “helpful to entrepreneurs.” This may be in part due to the diversity of background: 25% of our survey respondents were entrepreneurs, 22% work at a big company, and 17% are currently at other startups. This variety of experiences can help founders through different parts of the entrepreneurial journey.

Areas to improve:

- Not a natural tendency to angel invest: A common theme that emerged is writing angel checks isn’t top of mind for many would-be investors. Not only are these people not approached to angel invest, but it’s also viewed as a risky opportunity to deploy capital. There is a tremendous opportunity to increase the angel community in town, particularly if you look at the growing band of mid-level and senior managers and executives in larger companies in Seattle. One respondent shared “[There needs to be] more awareness that a lot of people can qualify as accredited investors. Many don’t know that – or what it means.”

- Evaluate deals effectively and efficiently: Another key area of improvement angels identified is around how to evaluate deals. Many angels articulated that they don’t see enough deals, with enough time in advance, to make educated, quick decisions about whether to invest. When they do look at companies, over 85% of surveyed angels focus on the founding team as the most important characteristic to evaluate an investment. In talking to a cross-section of entrepreneurs, this continues to be an area they want angel investors to be better at – making quick, efficient decisions that maintain a high bar for due diligence while balancing that against the entrepreneur’s time.

- Deal flow: perhaps the single most common thread that emerged from our survey was the lack of clear channels and consistent deal flow. While other angels and groups are great existing sources of deals, angels described wanting better access to the startup community, strong founding teams and opportunities to invest alongside institutions.

Overall – we were delighted at the survey participation and general engagement around this topic. While the angel community in the PNW is generally active, and increasingly so as the startup ecosystem continues to grow, there is work to be done to normalize angel investing as a logical opportunity to deploy capital in the Pacific Northwest and encourage new investors to join the fold. At Madrona, we have a few mechanisms like making room for angel investors where possible when we invest in seed stage and Series A companies, hosting annual angel meetups, and our Pioneer Fund, that are helping to facilitate more local angel investing – but they are just a start.

To all the angel investors in the Pacific Northwest – thank you for the work you do. It’s core to our broader technology ecosystem, and we are honored to partner alongside you in many of our investments at Madrona.