Is your SPAC Just a PIPE Dream?

(Previously published on ExtraCrunch).

This past year has brought many new developments to a historically traditional process: taking a company public. Many of the standard levers in an initial public offering (IPO) are being redefined as we write. The emergence of direct listings is just one example. Even in more traditional IPOs, we have seen unique lock-up provisions, different auctions approaches, virtual and rapid roadshows become the norm and company-centric approaches to investor allocations.

But clearly the most disruptive trend of the past twelve months has been the onslaught of the Special Purpose Acquisition Company, commonly known as SPAC. A SPAC is a company with no commercial operations that is formed strictly to raise capital through an IPO for the purpose of acquiring an existing, private company. Also known as “blank check companies”, these entities typically have 24 months to find a company to buy or merge with. That process essentially makes the acquired company a publicly traded one. SPACs can, and generally do, raise additional capital in the form of a PIPE (Private Investment in Public Equity) in order to reaffirm the SPAC valuation and raise additional capital with the identified target company.

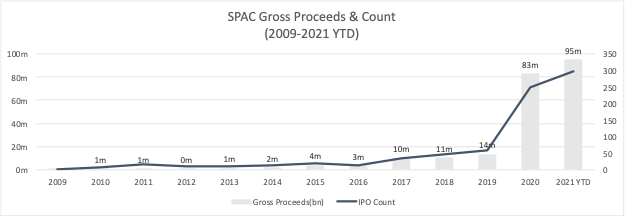

SPACs have been around for decades, but they took the 2020 IPO market by storm. For some context: 2020 had more than 248 SPACs – more than the sum of the previous decade combined. And while SPACs and the general sentiment around them continue to evolve, 2021 started off strong with 298 newly formed blank check companies to date, that have raised a collective $95B (vs. $83B in 2020). It’s worth noting that there has since been some slowdown in new SPAC formation and an uptick in regulatory caution – and we expect such shifts to continue in these early days.

For a SPAC, finding a company to merge with in 24 months might sound like a good amount of time – but in reality the diligence and SEC process can easily consume six months or more. So, identifying the target company relatively quickly becomes critical. As a result of this new trend, many private companies are being approached and courted by a number of newly formed SPAC’s.

At Madrona, we invest in companies early in their journey (often Day One), and walk with them through the years of opportunities, challenges and financing goals. As such, for many of our companies the conversation around raising capital via a SPAC transaction has come up – and more than once! How to evaluate the pros and cons of SPACs relative to other financing options can be convoluted and confusing, to say the least.

Are you ready to be a Public Company?

The fundamental thing to remember about the SPAC process is that the result is a publicly traded company: open to the regulatory environment of the SEC and the scrutiny of the public shareholders.

So, as companies are approached by interested SPACS, the absolute first question is not whether this is a good avenue to raise capital, but whether the company is ready to operate publicly.

In today’s fast-paced IPO world, going public can seem like simply a marker of success, a box to check. In reality, being a publicly traded company opens up a whole new world. Companies should contemplate whether they have the appropriate scale, management team, systems and reporting infrastructure in place, before even thinking through the type of transaction that would take them public. Too early will result in nervousness from new investors, which shows up in share prices almost immediately (including during the SPAC process) – and will affect both current employee morale as well as the ability to raise future capital. It’s important to have honest conversations at the executive level about whether operating publicly is something that makes sense for the company.

Benefits of the SPAC process:

Once it’s established that the company is mature and ready to manage public investors and regulatory scrutiny, it then needs to evaluate the best path to getting there. Historically, the IPO process had been relatively standard. 2020 has opened new avenues via Direct Listings, Reverse Auctions, interesting lock-up terms and SPACs. All these methods have pros and cons – that companies should take a hard look at.

Timing and Pricing Process: As we think about the SPAC process, there are a few things that can be helpful. First, it is a slightly lighter process and can result in less time from start to close to become a publicly traded company. In addition, the company gets a preliminary sense of price visibility much earlier in the process. In a normal IPO as well as a Direct Listing, the offering price moves and changes right up until the last hour. In a SPAC, the valuation of the company is negotiated during the initial M&A process, much earlier on in the cycle. This valuation will be validated through the PIPE raise process and then again during the “de-SPAC” process (where the original investors have an opportunity to sell back their shares at original SPAC price). This price visibility enables the company to have a firm understanding of how much capital they will raise and to build their plan accordingly. The company still needs to be mindful that both the PIPE and SPAC redemption processes cause the price to be re-set, and occasionally, the SPAC deal to fall apart.

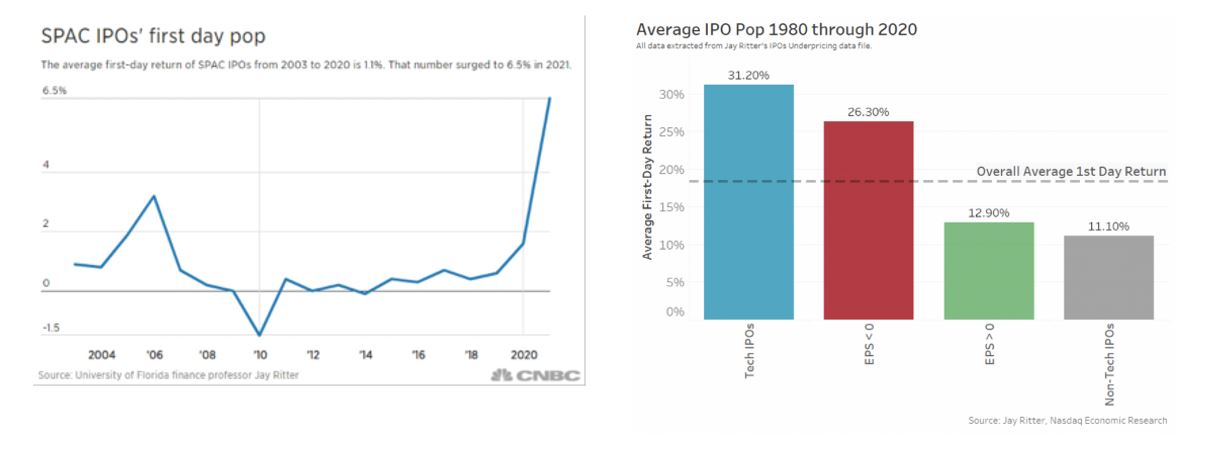

Pricing Levels: While it is still early days, what we are seeing so far is that, in addition to the pricing process there is less price dislocation or ‘Pop’ on the first day of trading. Through the M&A and PIPE process, the company is more market-valued and tends to issue equity on a higher price point. This typically removes some of the first day ‘pop’ that favors investors, but not the company. According to CNBC, the average SPAC pop was 6.5% in February. In contrast, the average pop for a tech-IPO in the last 40 years has been over 30%. These results are early but promising for the benefit of the existing shareholders in the company merging into a SPAC. Note that SPACs are also early – these structures are evolving and many are still working through SPAC sponsor economics (promote and warrants), how to manage lock-up periods, and navigate the three periods of price validation (signing the M&A Letter of Intent, completing the PIPE and completing the De-SPAC/redemption phase).

‘Day One’ Investors: The other important element is the ability to manage your ‘Day One’ public investor allocations. In both the Direct Listing and traditional IPO process, the allocation of shares is a nuanced and challenging process that often results in an allocation that is more in the investment bankers control than the company’s control. With the SPAC process, a company can really choose their investors by knowing the Sponsors and raising the PIPE- vs. the traditional roadshow process.

Different Flavors of SPAC’s

If a company decides to move forward with the SPAC process of going public, it’s important to choose the right SPAC. In other words, a company needs to choose the right set of sponsors to take them public. As SPACs have flooded the market hunting for companies, the quality and benefits of the sponsors that back those SPACs vary dramatically.

A SPAC is, at a basic level, a group of individuals coming together to put their expertise into finding a company that supports their thesis and skill set. Some are put together by operators who intend to lend their expertise to the company, and others are more financially focused. A company going public via SPAC should consider the following:

Quality: Do the sponsors have the quality and credibility to help raise the PIPE and support the deal?

Economics: Economic terms around SPACS have evolved substantially. Are the Sponsor’s economics aligned with a positive outcome for the company or are the deal teams primarily earning the sponsors returns, while protecting their downside? The economics can be tricky, but need to be deeply understood – how does the Promote work? Are the sponsors investing in the actual offering or just the initial capital? What happens if the PIPE is not raised? Are they aligned with benefiting from a rising stock price throughout the years?

Value-add: Finally, what knowledge and skills are the sponsors lending to the company and how committed are they to that? Sponsors need to add value far beyond just the initial IPO – and this is the driving factor of economic returns – the expertise and help the sponsors can add to the company. So, is it real? And if so, how valuable is it?

The year 2020 gave us a great deal to navigate – new ways of living and communicating, new challenges and – new ways to raise capital and access the public markets. Seeing the dislocation of the traditional IPO process is exciting – it’s no secret it was wrought with inefficiency. Ultimately, however, a company needs to answer whether it can walk into the public arena before it decides to run with a SPAC.