When Madrona Venture Group was founded in 1995, it did not start by raising a venture capital fund right away. In the early days, Madrona invested with funds solely from the four founders: Tom Alberg, Paul Goodrich, Gerald Grinstein and William Ruckelshaus. It was a “super” angel group, so to speak. One of those early angel investments that Tom Alberg made was in a first- time founder with a plan to sell books on the internet – Jeff Bezos and the company that became Amazon. 25 years later, Amazon has fundamentally changed retail as we know it.

It took four years of investing as angels before the founders decided to raise an outside fund. Building on this history, we, at Madrona, have consistently had a focus on investing in the early stage of companies over the intervening years and have a deep understanding that, for founders, these investors, and other assistance such as accelerators and incubators, at the earliest stages are the most crucial.

We have a long history of collaboration with the angel community here and continue to invest alongside them. Over the past decade, Madrona has participated in 78 deals alongside angel investors, mostly in companies here in our region. In fact, some of our most recent investments have been alongside angel investors, including The Riveter, OctoML and MontyCloud.

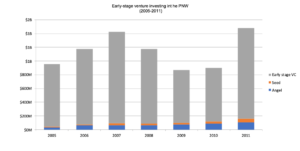

The total capital invested by angels in the PNW has steadily increased over the last decade. Alliance of Angels, Keiretsu and Element 8 have been among the most active angel investing groups in the PNW – investing in a combined total of over 1,300 deals over the last decade.

While the individual checks an angel investor or group write may feel small in comparison to the ever-increasing later-stage rounds, that amount adds up. According to Pitchbook, there were 25 PNW angel groups that made investments in 2019, totaling $145M in capital contribution. In contrast, 2009 had 12 PNW angel groups that invested a collective $11M. As part of angels’ commitment through the long run, they participate in later-stage rounds as well. In fact, angel investors participated in over 200 deals that raised $2.8B in the PNW in 2019 alone.

It is important to note that angel investing’s importance extends far beyond capital. While these investments may come in different forms and sizes, a common denominator is the support they provide at a critical time in a new company’s journey. Angels invest early, sometimes alongside seed stage investments from larger funds like Madrona. These investments are personal, ones that the investors are particularly passionate about – and subsequently, angels are known for rolling up their sleeves and getting deeply involved in formative stages. Not only can they be a key factor in reaching the next stage of funding by bringing other investors and VCs to the table, but angel investors provide advice, coaching and network access that remains influential throughout the entirety of a company’s journey. As an example, the Angel Capital Association estimated in 2017 that roughly 40% of angel investors take board seats, and almost 50% have active board advisory roles. In short, when angel investors commit to fostering this growth, they are giving back to the community over the long run – and truly living up to their name.

For those who have yet to take a step into this community, angel investing can be an incredible way to get involved in the rich and vibrant startup community in the PNW. To some, it may seem risky a risky endeavor, rife with unknowns. In many ways, this is the beauty of angel investing; taking a bet on a founding team in an early stage company and helping them navigate growth challenges is an invigorating way to allocate both your capital and time.

A study of over 1,500 angel investors in the US showed that nearly 66% initially got involved in the discipline through angel groups. Participating in these larger groups and communities can create a structured approach, share risk across a variety of investments, learn from each other and alleviate some of the initial apprehension to starting angel investments.

Downturns do affect investing but if history is to be believed, not that much when it comes to angels. Take 2008 for example where angel investing was relatively consistent through the downturn. The total early-stage venture funding raised in the PNW dropped by 13% from the prior year, and again by 9% from 2008-09. However, seed stage and angel investing only decreased by 10% from 2007-08, and actually increased by 18% the following year, bouncing back to pre-recession levels within 2 years.

If we use sentiment as a historical guidepost, we would have expected to see the venture community invest in fewer deals, at lower valuations and increase their focus on existing portfolios. We have demonstrated, however, resiliency in the face of difficulty. And now, more than ever, fostering innovation is critical.

Madrona has always been excited about the technology innovation and start-up ecosystem in the PNW, but today, we are reaffirming our commitment to invest through the downturn. We continue to remain focused on investing from Day One to the long run. As Seed stage investors, we will roll up our sleeves and partner to go the distance together. By extension, that means working closely with angel investors, other seed funds and entrepreneurs in the community.

We will continue to support Create33, TechStars, Madrona Venture Labs, AI2, FFA among other groups that help get startups ready for any kind of early stage funding. Further, we have a roundtable of start-up founders and senior technology executives working with us on our Pioneer Fund. These experienced technology execs are also angel investors. The Pioneer Fund enables them to bring more funding to startups through partnering with Madrona in their own angel investments.

To other members of the ecosystem – angel investors and other funds alike – let’s lean in through this tough period. We have a shared responsibility to help both existing and new start-ups continue to innovate through this downturn. Washington State has led the country in COVID-19 responses in a number of ways already. Together, we have the potential to continue leading by demonstrating our commitment to the start-up ecosystem in the Pacific Northwest.