Madrona is approaching our 25th Anniversary as a firm committed to seed stage investing in Seattle and the Pacific Northwest. Over the past 25 years we have made 155 seed stage investments (on average 6 per year), from Amazon in 1995 to OctoML in late 2019. In the early days, Madrona was a “super angel” group, and today we continue our passion for seed stage entrepreneurs and their companies. We are active in the ecosystem as long term supporters of seed groups including Techstars, Madrona Venture Labs, other labs, Create33, UW’s Startup Hall and many more.

By definition, seed stage investments are “Day One” opportunities. We believe that rolling up our sleeves with great entrepreneurs from the earliest days creates a material advantage for company success. We also believe having an investor partner with the capital, commitment, and expertise for the long run (often 10 years or more) provides the greatest opportunity for entrepreneurs to realize their highest aspirations. Madrona was recognized last year for exceptional outcomes for our seed investments by The Information. Eighteen Madrona-backed companies have gone public and over 60 have been acquired for positive outcomes over the past couple decades and we were the seed or Series A lead investor for most of those companies. We also keep learning from the over 75 current Madrona portfolio companies across all stages of growth. Based on our experiences, here are some thoughts entrepreneurs may find helpful about partnering with investors from Day One for the long run.

Finding Long-Term Partners Upfront

We often get asked by entrepreneurs what partnering from seed stage onward with Madrona looks like. We encourage entrepreneurs to talk with the founders and CEOs who have experienced this partnership, including companies that were big successes and those that did not achieve their goals. In addition, founders should ask any potential seed stage investors their perspectives on how they will add value near term and help build the company over the full journey.

Seed stage investors are generally looking for alignment with an exceptional team that is passionate about a customer problem and has a vision for novel solutions. Investors want to work with founders who have an insatiable curiosity and humility around what they know and the questions they are trying to answer. And, these founders have the market understanding and technological capabilities to build a compelling solution while attracting other team members to help build the company. Finally, the founding team and the seed investors need to share general core beliefs about the timing and nature of big market forces that can enable the company to succeed.

As a founder, you hope to find investors with big picture views similar to your own and relevant experiences that will directly help you succeed. It is especially useful to get beyond “pitch mode” and have a conversation about themes and real-world learnings. A good example here is how we have partnered with entrepreneurs around one of our major technology investment themes –the rise of “Intelligent Applications”. For the past decade we have been investing in seed and first venture rounds of companies that fit this broad theme. Horizontally focused companies we seeded in this area include Turi, Algorithmia, Xnor.ai and OctoML. Vertically focused companies have included Amperity, Highspot, Tesorio, Suplari and most recently Clari. The intelligent applications investment theme is just one of our key areas of focus and experience. The main point here, though, is for founders to seek strong alignment even at the seed stage with investors who understand their market and how a company in an emerging sector can be built over time.

Going the Distance with Capital and Value-add

Companies built to last take a long time to build! Entrepreneurs take the greatest risk because they are highly concentrated on one big bet with their company. They deserve investing partners who think and act like owners, show respect and appreciation, and have the resources to support the company over a long period of time. Founders can get the best of both worlds from a venture capital firm that has proven seed stage investing and multi-stage company building capabilities. They should expect investors that will combine their capital, time, experience, and value-add to help a company materially increase the probability of long-term success. Every company has its own journey. But experience has taught us some common lessons and patterns around navigating the entrepreneur’s journey.

- EVERY company has one or more “near death” experiences. There are just too many things you can’t directly control (macro forces, market timing, regulations) and too many times you make sub-optimal choices (hiring, product priorities, go-to-market strategies) to always get it right. Having both macro awareness and self-awareness helps the most successful entrepreneurs navigate and grow from their “near death” situations. Isilon Systems had hardware reliability issues that forced a product “stop ship” in the Spring of 2003. Smartsheet had to rewrite its front-end in 2009. Amazon may have run out of cash in 2000 if they had not raised a substantial amount of debt before the market crashed. Having investors who have been through these experiences can be grounding and also provide valuable guidance in challenging times .

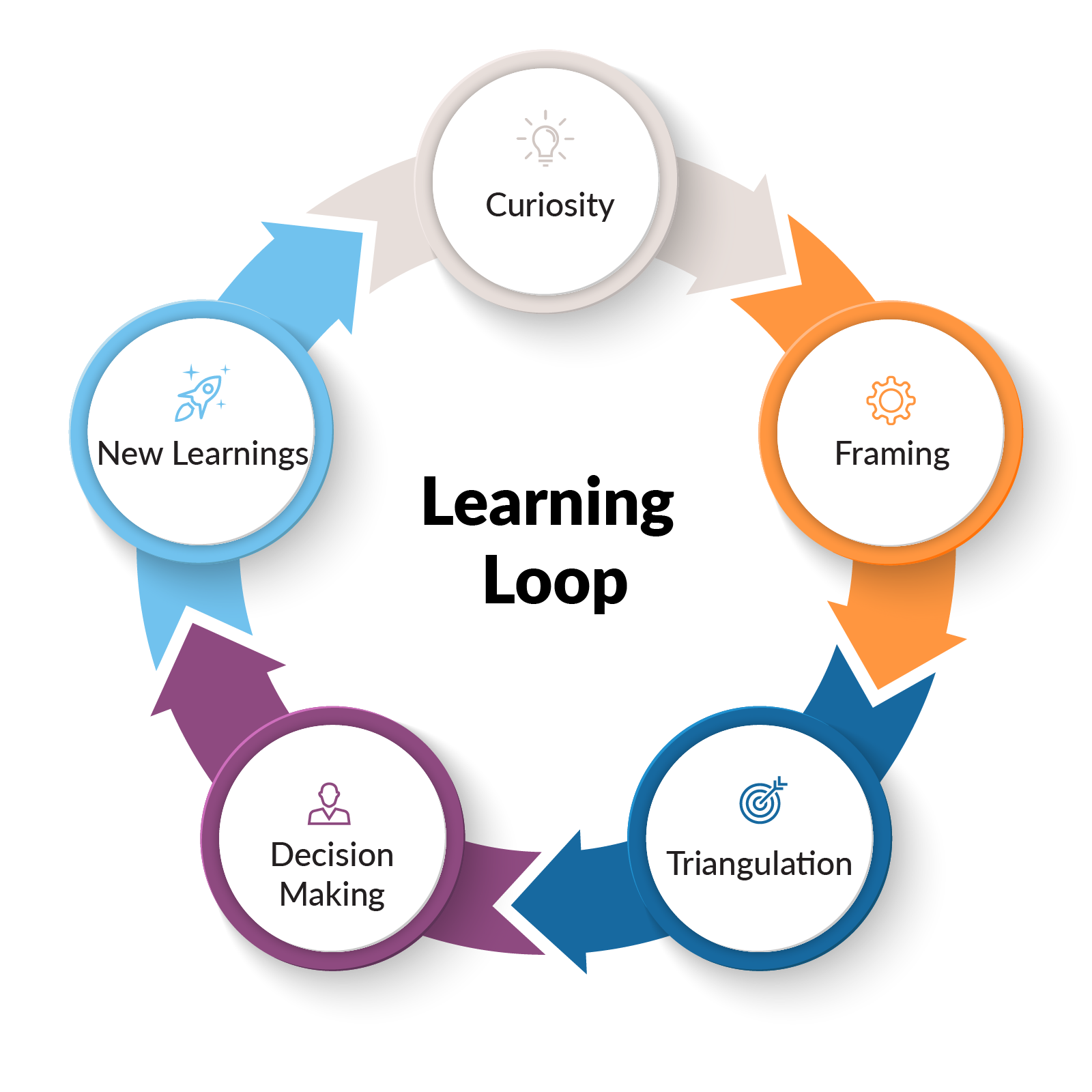

- Establishing your own style of a “Learning Loop” culture and process can significantly improve the potential for success. A learning loop culture combines curiosity, triangulation and rapid decision making to help a company learn better and faster than others. It is important to establish this culture early, at seed stage, so that you can absorb and grow from “experiential learning”, quickly dial-in initial product-market fit and create a virtuous cycle of customer and market understanding. This “formula” can help a company achieve early market leadership and establish a foundation for greater success. Your investors will be on this road with you as well so finding curious and thoughtful partners is key to navigating this continuous cycle of learning together.

- Look around corners and make hard choices at every stage. Circumstances are always changing and scale breaks people, processes and sometimes strategies. For example, finding and starting to scale product-market fit is an exhilarating phase of the company building journey. Having found that initial fit usually means your company will at least have a positive outcome someday. But there are many challenges to scaling and sustaining early market leadership. Initial products often meet a minimum threshold for bleeding edge customers, but the next set of customers expects more. Early employees who are great at running small teams or being individual contributors aren’t necessarily interested in or capable of running larger teams. In addition, established competitors start to mimic your messaging (even if they don’t have a product) and other startups observe your success and “pivot” to your market. At each stage of scaling, you want investors, board members and management teams who you have built a trust-based relationship over years of working together. And, you want them to keep looking around the corner to anticipate emerging risks and respectfully raise valid concerns. This type of trust-based relationship takes time and shared experience to establish.

- Financial transactions, especially M&A and IPOs, are usually the most intense and potentially misaligned periods in a company’s journey. During these times, trust and transparency are put to the test and are crucial to navigating these waters successfully. Most companies go through several rounds of financings. And, whether it is a Series A, Series F or an IPO financing round, they are always intense. In fact, the process of selling a company in one form or another (acquisition, recapitalization, merger) is the only time that is more anxiety-inducing than a financing round. This is especially understandable for founders and key executives who may be experiencing that process for the first time and are “all in” on the company.

Further complicating the intensity is the potential for misalignment between management and investors, and sometimes between the major investors. Investors can have different time horizons for when they hope to sell. Other times investors have different levels of capital to invest in follow-in rounds leading to different views on financing strategy. Investors also made their investments at different valuations, terms and ownership levels. Often investors can have varying views on strategy, capital requirements and operating plans. And, that is just differences you may encounter amongst your investors! Founders and senior executives might have differing views on all the above topics as well. And, they can feel misaligned with one or more of their major investors/board members as a result.

For example, a broadly held view amongst Silicon Valley investors the past few years was to delay going public for as long as possible. Comparatively “cheap” capital for later-stage private companies was available and the temptation to raise private capital was strong. In some situations where a business didn’t yet have sufficient scale or predictability, staying private was advisable. But, in many cases the combination of cheaper capital and less business scrutiny led private companies to insufficiently focus on unit economics and value creation. Regardless of the specifics for any one company, the IPO timing debate highlights how financing decisions can lead to misalignment between and across management team members and investors. Having investors who have been long term trusted partners accustomed to transparent communication with the entrepreneur gives the company a clear advantage in getting through transactional times.

Some Questions to Consider

While it is hard at the seed stage to be thinking around the corner to future financing rounds, potential IPOs or eventual M&A scenarios, it is critical to understand the experience and perspective of your seed investors. Are they committed to building a trust-based relationship with you over the long-term? Do they roll up their sleeves and continually add value at each stage of the company? Have they shown good judgement and sought alignment during financings and sales of prior companies? And, do they appear energized and culturally aligned with you and your team to build a great company over the long run? If you are answering yes to these questions, you and your investors are likely on an aligned and positive path to success. If you are just starting to evaluate outside capital and investors, I hope these thoughts and questions help you and your company achieve your goals!