Watch the full conversations on our YouTube channel: Sunny Gupta | Aaron Easterly

When founders are early in their entrepreneurial journey, they often face tough choices about who to raise capital from and what to expect from those investors. If you are fortunate to have compelling founder-market fit, you will likely have several investor options. Investors will try to convince you they are your best long-term partner. Often, this is the first time a founder has started a company and raised capital. It can be hard to distinguish between investor persuasiveness and a genuine ability and commitment to being in your corner from day one for the long run. At Madrona, we believe the best founders need and want great partners for the long, unpredictable, and challenging path to successful company building.

Every year, Madrona’s investors, called Limited Partners, attend our annual meeting. We discuss company and fund progress over the past year and forecast what we expect will happen in the future. This year, we focused on the long-term commitments that we believe venture investing requires to build trust-based relationships and lasting companies.

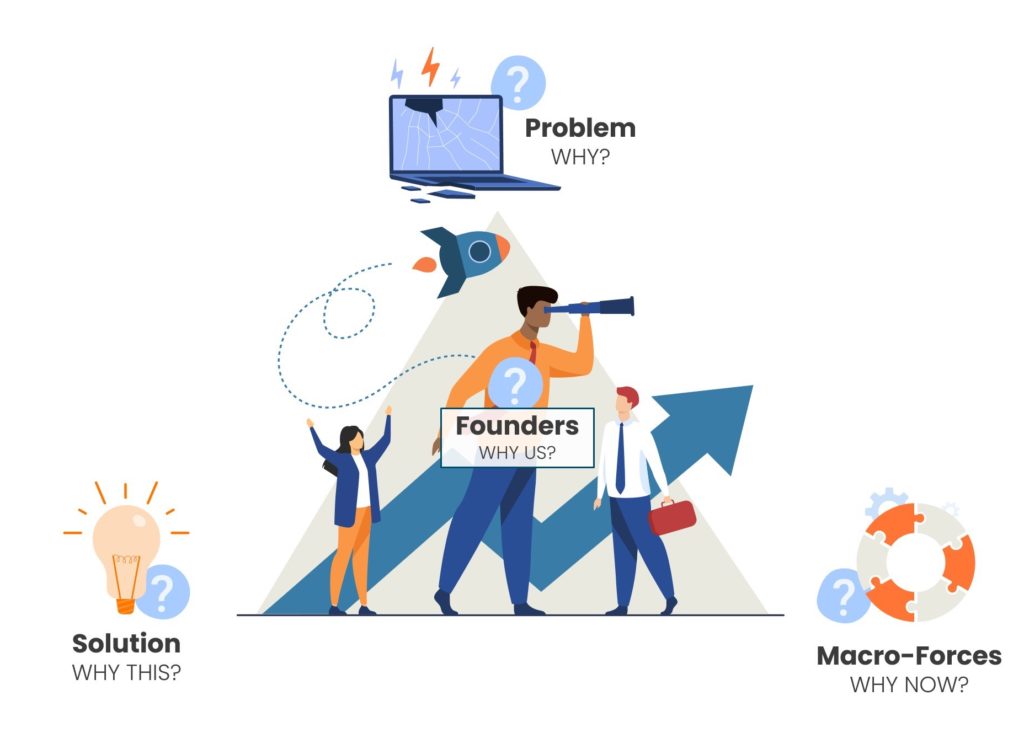

When investing in founders, we invest in people, their vision/ideas, and the company they formed to deliver a better solution to a customer problem. The founders are also making an investment in our partnership. They trust us to help shape the strategy, open doors to customers, employees, and business partners, and attract the future capital needed to maximize value. “Day One for the Long Run” is a phrase we have used for years to describe our way of working with founders from the earliest days of the journey. No matter our entry point, our long-term commitment is the same: We roll up our sleeves from Day One to help entrepreneurs in an authentic way create a valuable business.

At our annual meeting in Seattle in March, we hosted three fireside chats with founders and CEOs we worked with from the earliest days for more than a decade. Smartsheet CEO Mark Mader, Rover CEO Aaron Easterly, and former Apptio CEO Sunny Gupta talked about their journeys of company building and the lessons learned.

These founders and their companies had moments of despair and uncertainty, but they chose to invest in personal growth and build teams that could overcome the inevitable challenges. Their stories are truly incredible, and we are thrilled to have been there from the beginning to participate in the evolution and support along the way.

From these conversations, there were three consistent themes: A company’s mission should guide its decisions; startup journeys are rollercoasters; and always look around the corner to ensure you are headed to the right destination.

Your Mission Guides Decisions – Big and Small

Building a company is full of twists and turns and endless possibilities to expand or add to product lines or business units. But how do you know which opportunities to pursue and which to let pass by?

Aaron Easterly talked about how Rover uses its mission to make it easier for people to experience the love of a pet to guide their decisions. With their global audience, they could expand in many directions, but with every opportunity or idea they come back to — “Is this an impediment to pet ownership? Would someone not get a pet if this thing didn’t exist?” This focus helped keep their North Star clear.

Similarly, Apptio’s mission to help CIOs show the value they created for their companies (vs. being perceived as a cost center) led directly to building the Technology Business Management category. Apptio knew CIOs would embrace this new approach to transparency and communication. Seeing the opportunity to work closely with their customer group to build this mission broadly, Apptio created the Technology Business Management Council, which attracted CIOs from global brands and Fortune 500 companies to shape industry standards, share best practices, and learn about emerging technologies. This category creation and relationships with the world’s most powerful CIOs led Apptio to a successful IPO and, ultimately, an acquisition by IBM. (Watch the full conversation with Sunny Gupta here.)

Startup Life is a Rollercoaster

Every company that makes it in the long run has some kind of near-death experience. When this happens, you need trusted partners to help you consider the options and make the best decisions possible.

Smartsheet’s near-death experience came in 2008 — amid the financial crisis. It was clear that Smartsheet’s product needed both a front and back-end overhaul. The founders believed strongly in their mission but had to rethink their approach. The big problem was the company was running out of cash, and a rebuild would take significantly more than a couple of months. Madrona also believed in the mission and the people at Smartsheet and chose to reinvest to support the product rebuild. By early 2011, Smartsheet was on a path to success. The company went public in 2018.

“I’m really appreciative and grateful to Madrona for being patient with us. There were a lot of uncomfortable meetings where we weren’t delivering for you, and you stuck with us, as did the LPs indirectly. It really changed a lot of our lives and the lives of our customers.”

— Mark Mader

Rover’s near-death experience was one that impacted many companies — the global pandemic in 2020. A company that had built its business on people going on vacation or going to work while their pets were at home was suddenly in a negative revenue situation. A circumstance that no investor or company leader could have ever anticipated. The team had to make tough expense management decisions and do so quickly. But, Aaron Easterly and his leadership team could also anticipate and prepare for the future. As the world navigated through the worst of the pandemic, they believed there would be a lot more pet parents out there who, having adopted pets in the pandemic, would need help with their new family members. While Aaron isn’t convinced his employees at the time believed him, it quickly became apparent that was the case, and the tailwinds of business from the boom in pet parents came. Rover was purchased by Blackstone for $2.3 billion earlier this year.

“It has been a privilege to have people as long-term oriented as our investor base. When we agreed to sell, something like 30% of our cap table belonged to people who had been in the company ten years or more. That’s not a privilege a lot of people have.” — Aaron Easterly

Look Around the Corner to get to the Best Destination

Focusing on the future – and making well-considered decisions with a long-term view was a consistent theme across all three conversations.

Apptio, uniquely positioned for having gone public and subsequently been acquired twice at increasing company valuations, received numerous offers for purchase throughout the years. Building a category is not easy and not fast. One of these offers came on the eve of going public in 2016 and was significantly above its IPO price. However, the company, with the support of Madrona, believed that there was greater value to unlock as a public company. While life as a public company wasn’t always easy, greater value creation proved to be the case with the purchase by Vista at nearly $2 billion in 2019 and the subsequent sale to IBM in 2023 for $4.6 billion.

“A lot of the lessons I’ve learned have come from my partnership with Matt and the rest of the Madrona team. From day one, I felt that long-term commitment to me as a founder. From an entrepreneur’s perspective, I cannot underscore the importance of that enough. Every day, you’re going to feel lonely. But a committed partner is kind of like having your parent’s unconditional love. And I have genuinely felt that with Madrona.” — Sunny Gupta

Smartsheet remains a public company today, and their performance is judged every trading day and quarter. They have adapted by embracing scalable accountability while maintaining a long-term commitment to their customers and employees. This led them to adopt new technologies such as cloud-native architectures and GenAI that deliver enterprise-grade work collaboration to customers of all sizes. They have also grown their footprint through thoughtful acquisitions and productively evolved by being open to changes and contributions from new team members. Founders should focus on building a solid foundational culture that can adapt and grow as a company scales.

Ask A Founder What They Experienced

When first-time founders ask us to describe our approach to partnering for the long term, we are honored to be able to share stories like the ones above. We also have stories of amazing companies with talented founders whose outcomes weren’t so positive. The lessons from those experiences and how we worked to help those companies have the best outcome possible are equally important. That is why we always encourage entrepreneurs to talk to founders we have worked with in the past and ask them about their relationship with Madrona. Often, the best indicator of what will happen in the future is knowing the authentic experiences of working with a team in the past. We are thankful for the partnerships with outstanding entrepreneurs and long-term investors who help Madrona make durable commitments to companies for the full journey.