In recent years, Nvidia has transitioned from a pioneer in graphic accelerator chips to a key architect shaping the future of AI. Though it looks like an overnight success story, like most uber-successful companies, this one has been decades in the making. Like other big tech companies, Nvidia has adopted a multifaceted approach of investing, partnering, and hiring great talent, thereby fostering innovation within the early-stage AI and big tech ecosystems. By leveraging its resources and expertise to invest in and partner with early-stage AI companies, Nvidia is fueling innovation and strategically positioning itself as a linchpin in the AI revolution. And at Madrona, we’re excited to partner with a company actively investing in creating tomorrow’s AI success stories.

Since its inception in the early ’90s, Nvidia has been revolutionizing the way developers utilize graphic chips for computing. But Nvidia catapulted itself to the forefront of technological innovation with its 2006 introduction of CUDA, a groundbreaking GPU architecture allowing direct programming in C to accelerate mathematical processing and simplify its use in parallel computing. From then on, Nvidia has been at the forefront of technology inflection points, including gaming, crypto, autonomous driving, and, most notably, AI, solidifying its position as THE leader in the compute and networking space.

Throughout that work, Nvidia has become a crucial ally for early-stage AI startups, providing not just the computational firepower needed to explore new frontiers in AI but also strategic investments that can turbocharge their startup journeys. As Nvidia continues to lead the charge in compute and networking, its latest role as an investor is reshaping the AI ecosystem. This proactive approach has accelerated the growth and innovation of these startups and ensured that cutting-edge AI technologies reach consumers and businesses faster.

Nvidia’s Investment Strategy

Nvidia’s investment philosophy is clear: support companies that leverage its technologies, thus cementing its leadership in the AI market where its chips are nearly ubiquitous. The success of this strategy is evident in Nvidia’s staggering growth. In the past year, Nvidia’s annual revenue grew 265%– from $6B in FY2023 to $22B in FY2024. It should be no surprise that Nvidia has the third largest market cap in the world — exceeding $2.3T in March — just behind Microsoft and Apple. Just five years ago, the company was at about $109B.

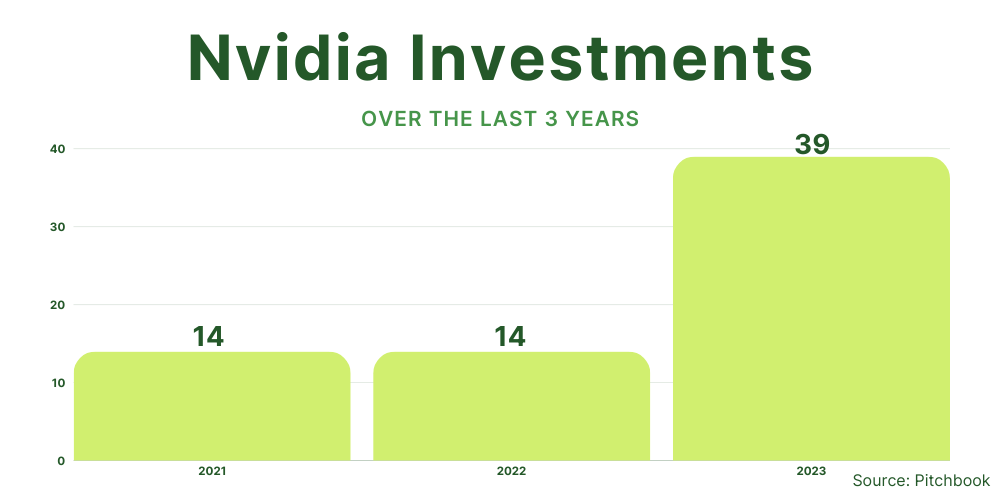

Nvidia’s aggressive investment strategy, highlighted by its backing of more than 100 companies over the last five years, according to Pitchbook, underscores its commitment to fostering innovation within the AI sector. Nvidia nearly tripled its activity from 2022 to 2023 and has already invested in eight companies in 2024, including two Madrona portfolio companies — Unstructured and Cohesity. Others include Perplexity, Cohere, Coreweave, Mistral, Together AI, and Imbue.

Madrona’s Partnership with Nvidia

Nvidia’s strategic approach signifies a profound understanding of the transformative potential of AI and a commitment to shaping its future. Recognizing Nvidia’s impact on nascent startups, Madrona has partnered with Nvidia on three other investments in addition to Unstructured and Cohesity — Runway, Deepgram, and Terray Therapeutics. Madrona also partnered with Nvidia as part of the Nvidia Inception program and the Nvidia VC Alliance Program, which provide our portfolio companies access to collaboration opportunities with Nvidia.

Terray Therapeutics

Jacob Berlin, CEO and co-founder of Terray Therapeutics, a small molecule drug discovery company, felt “pretty good” about its AI model Coati early last year when it was first trained. It was functional, but it could be better, he said. However, after Nvidia announced its investment in November, Terray retrained the model entirely, armed with boosted computing resources and Nvidia’s engineering prowess. Jacob told Forbes his company saw much better performance, “and we couldn’t have gotten there without the collaboration with Nvidia and their support.”

Cohesity

Cohesity, a leader in AI-powered data security and management, partnered with Nvidia to unlock the power of generative AI and data using Nvidia NIM microservices and by integrating Nvidia AI Enterprise into its Cohesity Gaia platform. After this announcement, which included announcing Nvidia as a new investor, Cohesity CEO Sanjay Poonen shared that the partnership was a testament to the promise Nvidia sees in Cohesity as a leader and innovator. “Through this collaboration, technology and business executives will have a unique opportunity to leverage the power of generative AI, turning information into knowledge while keeping their data both compliant and safe,” he said.

Unstructured

Brian Raymond, CEO and Founder of Unstructured, the leader in ingestion and preprocessing for LLMs, was excited to partner with Nvidia for its recent $40M Series B because he recognized the acceleration the partnership would provide for his startup. Unstructured utilizes a variety of models to extract, classify, and embed unstructured data, and working with Nvidia will accelerate the work the engineering teams are doing to optimize its ML pipelines for enterprise speed and scale. Brian shared that Unstructured is also “excited to deepen our support for their Nemo platform, a powerful constellation of tooling that Nvidia is assembling to assist developers in the GenAI ecosystem.”

Buy vs. Build

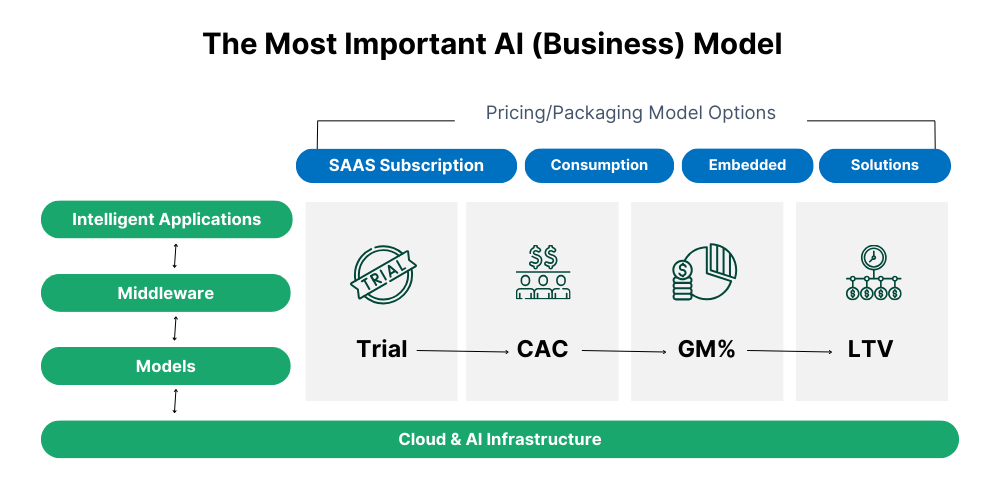

Amidst the ongoing wave of AI platform evolution, Nvidia’s strategy is part of a noticeable: As each big tech company vies to be the leader in AI, they have become increasingly creative when it comes to their buy vs. build approaches. No longer are big tech companies simply buying startups for the tech they have. Instead, they’re investing in the ecosystem. Microsoft’s investment and partnership with OpenAI — and its recent partnership with Inflection AI. Google and Amazon’s investments in Anthropic. Nvidia and Salesforce’s investment in the early-stage AI ecosystem. And this new multifaceted approach of investing, partnering, and hiring great talent fosters innovation within the early-stage AI and big tech ecosystems. But it’s worth acknowledging that this pivot is likely partly due to the intricate regulatory landscape that has presented its challenges for big tech firms accustomed to more traditional acquisition strategies.

Nvidia Shapes AI Winners

By aligning with nascent AI companies, Nvidia is fueling technological breakthroughs and gaining invaluable insights that fuel its advancements at the hardware and software layers. This symbiotic relationship between Nvidia and the AI startups it supports fosters a culture of innovation, driving progress and pushing the boundaries of what’s possible in AI development.

At Madrona, we are excited to see how the AI landscape will continue evolving with Nvidia’s help fueling tomorrow’s AI winners. We are equally excited to continue partnering with Nvidia on future AI investments. We believe Nvidia is laying the foundation for a future where AI powers change across industries and consumers, further driving innovation at a rapid pace.