This is the third in our series describing our investment themes for 2020 and beyond.

Software is eating the world, but today, most organizations have a limit on how quickly they can build software. While teams want to automate processes, get insights from their data, and build better solutions to problems, there are simply not enough people who can write software to do these things.

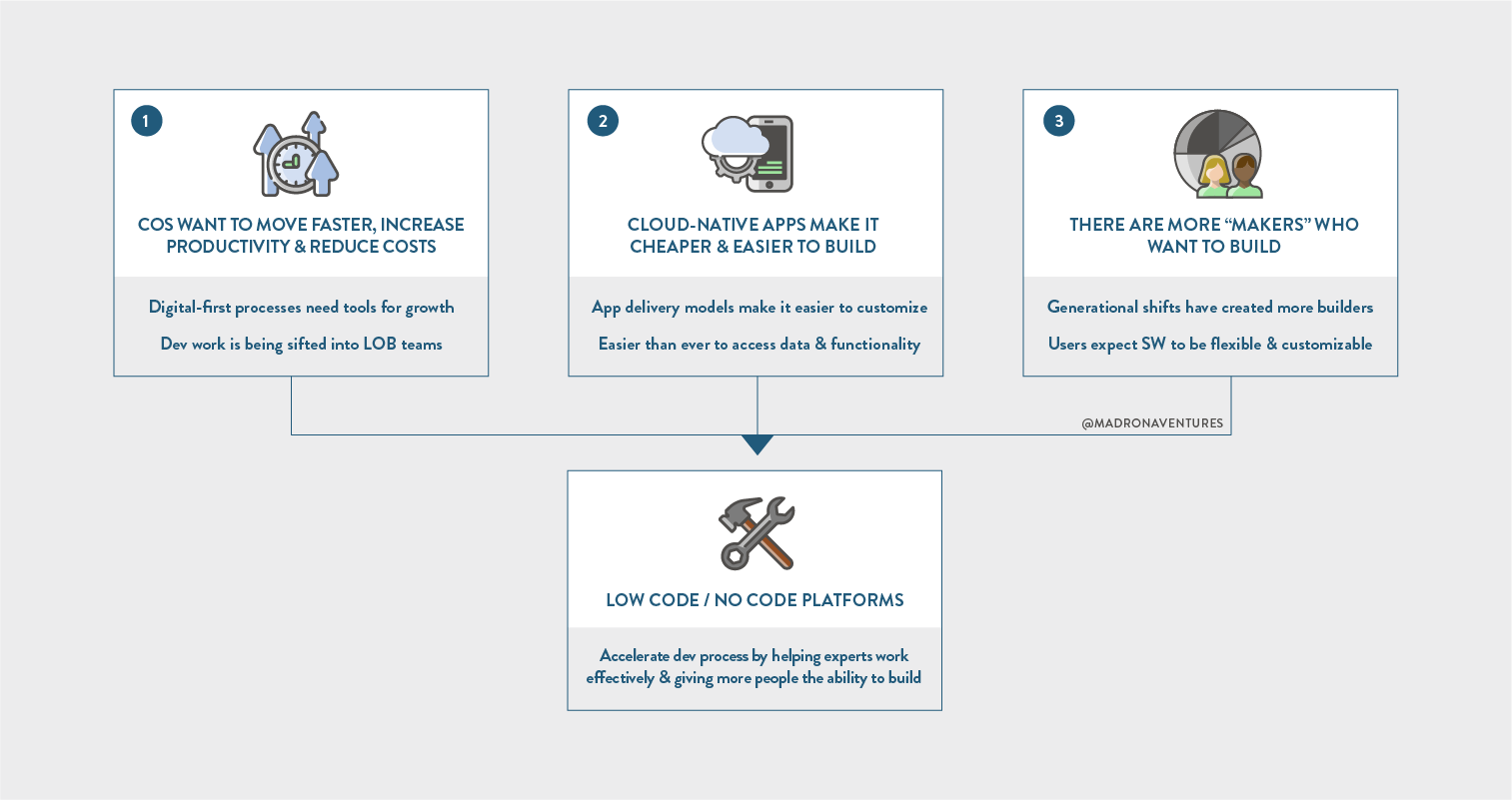

At Madrona, we believe low code and no code development platforms unlock new opportunities for people and companies around the world to accelerate the promise of “software eating the world” by (1) helping experts work more effectively and (2) giving more people the ability to write software.

(click into the image for full screen)

We think there are three major trends driving the adoption of these low code and no code platforms:

- Companies want to move faster, increase productivity, and reduce costs.

In today’s business environment, companies are shifting traditional ‘development’ work from IT and engineering teams into line of business teams. These teams want platforms that allow them to do their jobs without requiring engineering cycles.

- Cloud-native apps make it cheaper and easier to build

New application delivery models are making it easier than ever before to build powerful, customizable software. Not only are cloud-based applications cheaper to get off the ground, they also make it easier to connect to other apps, services, and databases.

- There are more “makers” than ever before

There is a generational shift underway in the technology world, and software “users” today have both higher expectations and more “coding” fluency than ever before. Users expect to leverage software as a flexible tool to suit their needs, and they are willing to spend time customizing tools for their individual use cases.

These trends are creating an inflection point in the adoption of low code and no code platforms that will drive new opportunities for makers, startups, and enterprises. We have already seen each of the major cloud providers bring low code products to market (Microsoft PowerApps, Amazon Honeycode, and Google AppSheet), and we are excited to see more innovation from startups as well.

Types of Low Code and No Code Platforms

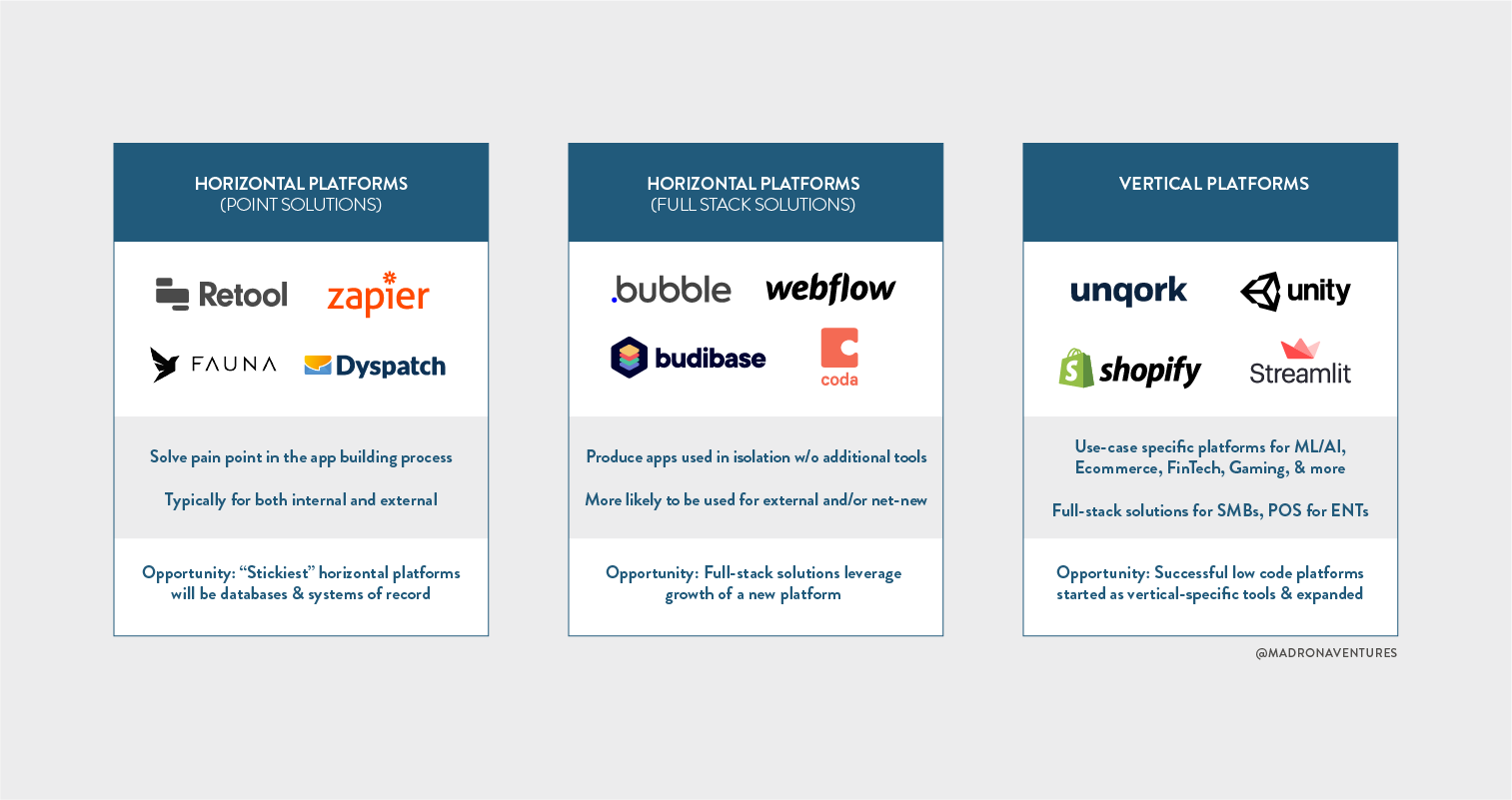

We take a broad view of low code and no code platforms as products that (1) help experts work more effectively and/or (2) give more people the ability to write software. We take this broad view because we believe this is a massive technology trend that will affect every “horizontal” and “vertical” software market.

However, to help us think through the different opportunities, we like to categorize products as horizontal point solutions, horizontal full stack solutions, and vertical platforms (which may also be either point solutions or full stack solutions.)

The distinctions between these categories are very blurry, and many point solutions evolve into full stack solutions over time, and many full stack solutions are often better at one piece of the application development lifecycle. But these categories help us understand the types of customer pain points and workflows that each product is trying to solve.

Horizontal Platforms

We like to think of the “application stack” for low code and no code platforms in three parts:

- The Interface Layer – The interface layer is the end-user facing part of a low code application that is typically used to either input data (e.g., better forms or data collection tools) or visualize data and outputs (through charts, apps, etc.)

- The Data Flow Layer – The data flow layer handles the basic create, read, update, and delete operations to the database in addition to handling business logic and rules and connecting to third party services and data

- The “Database” Layer – The “database” for a low code application can range from a Google sheet to a MongoDB Atlas instance. We think of the “database” for a low code app as the key system of record that the interface and data flow layers are interacting with

(click image for full screen)

When we take a closer look at a market map of horizontal low code and no code platforms, we can see that the lines between different types of solutions is very blurry. Companies operate between multiple layers of the stack, and while we see some distinctions between companies that focus on internal applications vs. external applications, the lines are very fluid.

Some of the key opportunities we see for horizontal companies are:

- Automate workflows that sit between engineering teams and other functional or business teams – Tableau is one of the best examples of this type of opportunity. Business teams want to have real-time data on performance, but the need to ask engineering teams to constantly make small changes to data queries and refresh dashboards has created an entire industry around low code solutions for business intelligence

- Build more functionality into familiar interfaces – Coda is an interesting example of a company that uses “familiar” interfaces like Word docs and Excel formulas to create a new type of doc that can have app-like functionality. By starting with familiar interfaces, it is easier to teach users how to “code” in a low code or no code setting

- Build horizontal products with a vertical GTM focus – Unqork offers low code solutions for forms and workflows that connect to legacy databases. Their initial GTM approach was to focus on selling to financial services firms, but they were able to keep their product flexible enough to work in other industries such as government, real estate, and education

Vertical Platforms

Historically, many of the most successful low code platforms started with a very narrow use case, and as they became more powerful, they expanded beyond what their original intended use. For example, Epic Games’ Unreal Engine was originally built as the game engine for a first party game. Eventually, the team decided it could be more valuable as a game engine for other game developers, and now it is often used as a tool to for movie visual effects and AR/VR app development.

We are very interested in these purpose-built platforms because they typically start with a specific customer pain point in mind, and this helps drive focus in the early days of getting a company off the ground. Over time, as markets grow and new opportunities arise, they also create the potential for game-changing companies – like Epic or Unity.

Some of the verticals that we think are particularly interesting right now for low code and no code applications are ecommerce, data science and machine learning, and infrastructure. We picked one industry vertical in ecommerce to illustrate vertical specific solutions, but we see that trend in other verticals as well.

Ecommerce

Within the ecommerce vertical, there are several opportunities for new startups to create new products based on the broad ecommerce value chain components. The broadest opportunity – where Shopify is already the clear leader – is a service to create end-to-end ecommerce stores and sites from scratch.

Shopify is the leader in this segment today, but we think there are several parts of the market that are underserved by Shopify’s current product. For example, we would love to see a company offer a seamless omnichannel commerce solution powered by a low code backend. We also think there will be companies that can build large businesses around category-specific services like frozen fulfillment, CPG, subscription, or alcohol.

For other pieces of the value chain, we see opportunities for companies to create better consumer-focused experiences, deploy custom functionality such as chat or checkout in an existing site, and offering better analytics and planning tools to existing stores and platforms.

Data Science and Machine Learning

Data science and machine learning is one of the fastest growing parts of the technology world, and this is a market with a clear need for tools that make it easier for more people to take advantage of the latest developments in machine learning research. For this market, we take a customer-centric approach to thinking about the user profiles of different types of data science “practitioners.”

The first category of users is data scientists and ML engineers who are familiar with the existing tools. These users already have established tool chains and workflows, and they are more comfortable working in code, so may find low code and no code tools less flexible than code-driven tools. One key opportunity for these users is tools to assist with data wrangling and ML Ops, which are the less enjoyable parts of their work today.

The next category of users is software engineers, who are comfortable writing code, but may not have a background in data science and machine learning. For these users, there are several tools that provide an onboarding ramp to data science, but they may prefer to use “high code” tools over time.

The last category of users is non-technical business users who do not write code today and also may not understand fundamental data science concepts. For these users, we believe there is a large opportunity to give them the tools to learn more about machine learning and apply ML techniques to their work. Today, we see tools that strive to support a myriad of different analytical problems. However, we think applications that focus on specific problems such as LTV prediction, churn prediction, or fraud detection will be easier to adopt by business users. The key challenge will be integrating the machine learning services into an existing process or workflow to make insights and recommendations effective.

Infrastructure

Unlike several of the other verticals we discussed, this is a category where most of the tools are built for software developers. Some of the key customer pain points that we see companies solving in this space include helping developers quickly set up a back end “as a service” for a new application, automating DevOps workflows, and building API gateways to connect applications.

Companies like Busywork and Darklang are building “backend-as-a-service” platforms to help front end developers and full stack developers quickly set up backend systems, in order to reduce the complexity and cost of building distributed application backends. Instead of building these systems themselves, companies can use a service to get something up and running quickly. Another example of a “backend-as-a-service” offering is a product like Auth0, which allows developers to quickly build authentication and authorization into their applications.

Another common development paradigm we are seeing more and more frequently is leveraging best-of-breed services from multiple third parties in a single application. One company that helps with this is Temporal.io, which is an open source workflow engine based on the Cadence OSS project from Uber. This allows developers to focus their time on writing business code, rather than the “glue” to piece different services together.

Conclusion

Digital transformation is happening faster than ever before, and we believe one of the major drivers of the next wave of digital transformation will be the transformation of software from static databases to dynamic applications that users can customize and build themselves. Over the next decade, low code and no code systems will evolve from separate systems to becoming a core design philosophy of software systems, and we are excited to meet with companies and entrepreneurs who share this vision!