Four Trends — The Enterprise’s Time has Finally Arrived

Amazon is hosting their 7th Annual re:Invent conference this week with over 50,000 attendees expected. AWS is approaching $30 billion in annual revenue run rate with a growth rate just shy of 50%. Amazon is the market leader in public cloud services and this year’s re:Invent conference comes at a fascinating time. Enterprise customers are embracing a broad definition of the cloud that is leading to more rapid adoption of both the public cloud and various edge cloud use cases. IBM is buying RedHat for $34 billion, Microsoft has emerged as the clear #2 player in the cloud market and Google is struggling to find their way (as evidenced by Diane Green relinquishing the Google Cloud role to former Oracle executive Thomas Kurian).

The four themes below highlight areas that Amazon will emphasize at re:Invent and provide a roadmap for the world of cloud computing from both a technology and go-to-market perspective in the years ahead. These themes will be highlighted and discussed in the main keynotes, working sessions and conversations throughout the week:

- Cloud computing is now the pervasive software model everywhere

- Data’s role has been transformed from system of record to system of action and intelligence

- Enterprise customers are finally ready to embrace the full potential of cloud models

- Partnership alignment is emerging as the key competitive dimension for cloud platforms

Cloud Software Models Are Everywhere

In the past several years terms like public cloud, private cloud, hybrid cloud, edge cloud and more have been used to try and distinguish between types of cloud deployments. But, increasingly any modern application is a cloud application in some form. The core technologies popularized in the public cloud like object stores, event driven functions, and scalable data services are being used everywhere. Those applications may still live “on premise” in a virtualized environment or they may live on a “thing” at the edge connected to massive computing resources at the cloud core. Regardless of where the application was developed or lives, it is based on technologies and processes that were built for the cloud. The pervasive development methodology is agile and iterative. And, the lines have blurred between developers and technology operators for the DevOps that keep these apps running. In that context, “clouds within cloud” and increasingly specialized cloud solutions are emerging for specific customer needs.

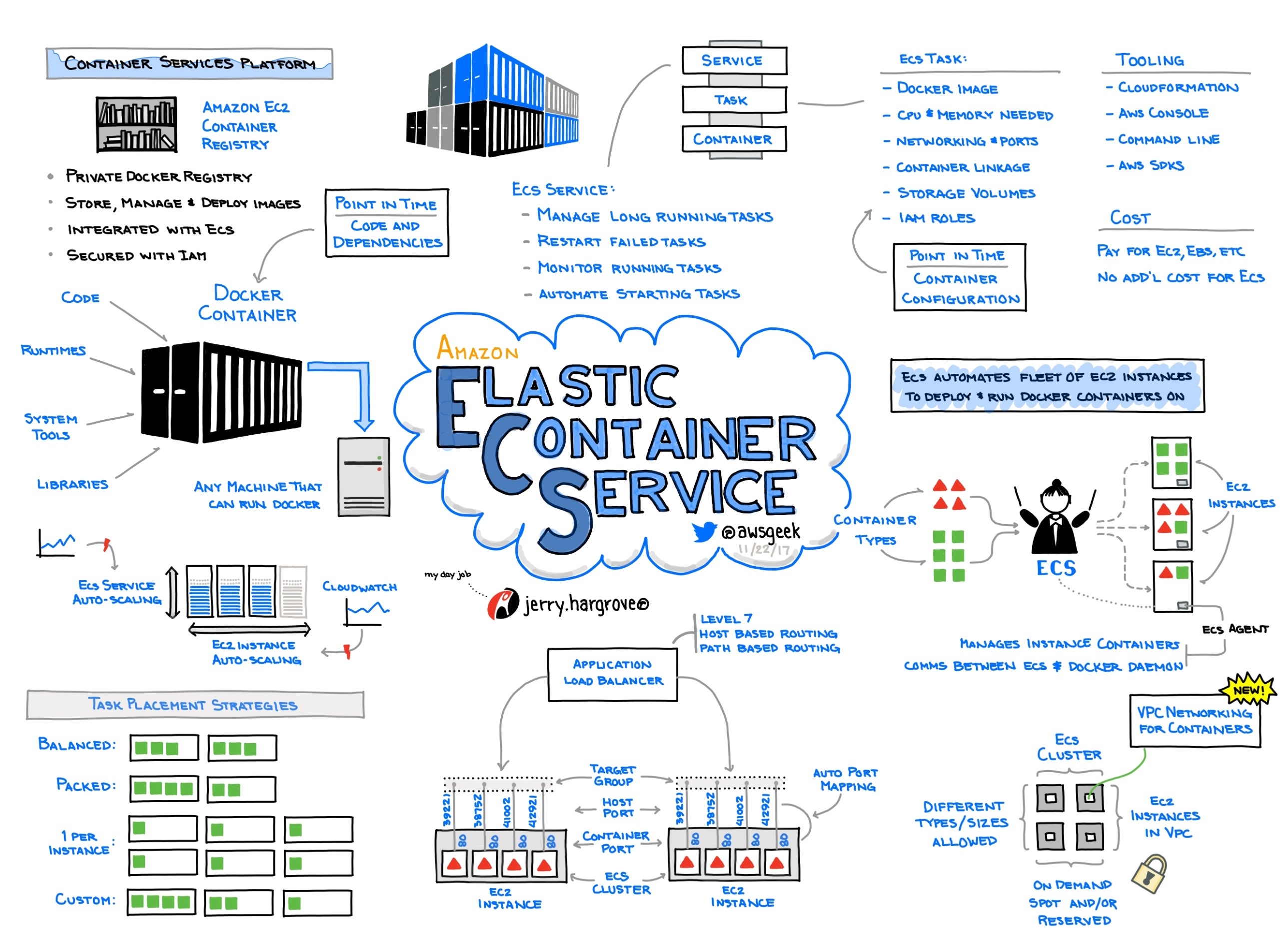

My expectation is the emphasis this year at AWS will be on expanding capabilities across several technology categories that make it easier for enterprises to adopt cloud. Compute instance types for CPU’s, GPU’s, FPGA’s and specialized deep learning processors will be expanded. Improved data management, databases and data warehousing capabilities will get launched. AWS’s suite of IoT offerings like Greengrass, CloudFront and FreeRTOS (operating system for microcontrollers) will be enhanced and highlight the growing opportunities for cloud at the edge. And, the capabilities popularized by the public cloud, including containers, event-driven functions, and EC2 instances will increasingly be available “on premise” to enable more hybrid application scenarios.

Data Unlocks Systems of Action and Intelligence

Even more important than “cloud everywhere”, is the transformation of applications through the power of data. Public clouds like AWS are a compelling place for data aggregation, preparation, manipulation, training and automated actions. Once your data systems are enabled in the cloud, you can evolve legacy “systems of record” into “systems of action” that are increasingly automated. From there, your data systems can expand to “systems of intelligence” that increasingly “know” the next best action to take. AWS, Azure, Google Cloud and others understand that if your data is stored and managed in the cloud, the next step is leveraging more advanced data intelligence services offered by your cloud of choice.

I expect that AWS will announce new or improved underlying data services in data streaming, data integration, data management and databases.They will also improve their machine learning application training and deployment capabilities (SageMaker) and their finished ML services (Rekognition, Translate, Comprehend (NLP)). Some of these services are built upon open source platforms and that community has raised concerns about how AWS leverages open source to build their own services. Finally, while subtle, AWS’s data services messaging will focus more on the benefits of AWS versus Azure rather than Oracle.

As it relates to data services, there are two key questions I will be looking to get answered:

- How will AWS position new and improved services relative to data services partners like Databricks, MongoDB and Snowflake who offer managed services on AWS today?

- Will AWS’s new data service offerings focus more on discrete services or integrated services that focus on holistic customer use cases and needs?

Enterprises Fully Embracing Cloud Models

With most central IT organizations and senior management now embracing the cloud, the products and messaging at re:Invent will be heavily focused on the enterprise “abilities”. These capabilities include securability, scalability, manageability and, increasingly, flexibility. While it is valid to assert that cloud security is better than most on premise data centers, security issues remains a risk to cloud adoption. Security offerings in the cloud and between the cloud and on-premise offerings are becoming more sophisticated. AWS will highlight their new offerings, but so will technology partners like Palo Alto Networks, F5, Tigera, and ExtraHop who can help enterprises secure workloads and enhance security operations on premise and in the cloud.

Central enterprise buyers also care about simplicity, transparency and standardization in the provisioning and management of workloads. I expect AWS to announce some new offerings in these areas as well. To do this, AWS will leverage their substantial investment in the AWS Marketplace which helps customers find, try, buy, deploy, measure and bill different cloud services to become a full-fledged services catalog and automated provisioning offering. AWS will also improve their broader billing and monitoring services to help enterprise customers address the increasingly complex world of Enterprise Discount Plans (EDP’s), Reserved Instances (RI’s) and various cloud migration incentive programs.

Despite not being part of the main keynote this year, VMWare will continue to have a major presence focused around enterprise customers. They have purchased CloudHealth and Heptio and increasingly partnered with companies like Apptio to assist enterprises with their journey to the cloud. Those services could be bundled with VMWare offerings to address the enterprise’s desire to have an independent partner’s perspective on cloud costs, management and innovation.

Partner Alignment Becoming Core Cloud Competition

With cloud deployments everywhere, data transforming applications and enterprise readiness high, the emerging competitive framework for major cloud providers is around how they partner with other technology-driven companies to meet the needs of customers. This is especially true in the enterprise, but the competition between clouds, cloud services and service providers exists across use cases.

AWS is the market leader and that position creates some advantages and challenges for them. On the advantage side, they can buy at sufficient volumes to partner well with infrastructure technology companies. Chip companies like Nvidia and Intel will undoubtedly have new offerings on AWS in the form of modern CPU and GPU service offerings. Contract manufacturers like ZT Systems will benefit from the massive scale and growth of AWS as a behind-the-scenes provider of infrastructure. And, while owned by Microsoft, a service like Github will continue to benefit from AWS’s early and ongoing deep relationship with the cloud developer community who offer ongoing feedback and insights to AWS product teams.

AWS’s relationship with other software providers, systems integrators and modern managed services providers are more complex. Some software companies, like the data services ones referenced earlier, face competing AWS offerings. And, sometimes those AWS offerings are built on open source software shaped by a community that favors “openness”. Established software companies like AppDynamics/Cisco, Splunk, and NewRelic are trying to make it easy for an enterprise to manage workloads whether they are in the public or private cloud. And, larger companies like VMWare and IBM/RedHat will increasingly be emphasizing how their software and services work and can help move workloads across the different cloud providers. Of course, hundreds of smaller, private companies will be attempting to leverage the AWS core infrastructure to deliver new solutions across application areas and vertical solutions with many of them building “intelligent applications” that leverage data, cloud compute and domain knowledge to solve specific customer problems.

In addition, enterprises are still trying to determine which workloads they can “lift and shift” in to the public cloud, which ones they can extend/expand to the cloud, and which ones are just not ready for the cloud (because of their proprietary hardware, high latency requirements or privacy/security concerns). These enterprises are looking for help from AWS directly and from a growing mix of cloud-native and traditional systems integrators. Those systems integrators are shaping the cloud strategies of enterprise customers by delivering more value in professional and modern-day managed services.

These realities lead me to focus on two key questions around cloud partnering:

- What role will AWS Marketplace play in aligning AWS with other technology partners and their end user customers?

- How do different partners view the quality of alignment they have with AWS relative to Microsoft as well as other cloud providers?

Beyond these four core areas, it will be exciting to see a broad mix of customer use cases at re:Invent. The agility and flexibility of the public cloud have unlocked innovations for private, non-profit and public sector customers of many shapes and sizes. Work done on AWS is helping people collaborate more effectively, improve their customer relationships, bring intelligence to automobiles, and even cure cancers. In the “cloud everywhere” world that exists today, AWS, their customers and their partners are only getting started!

Note: ExtraHop, Tigera and Snowflake are Madrona Venture Group portfolio companies.