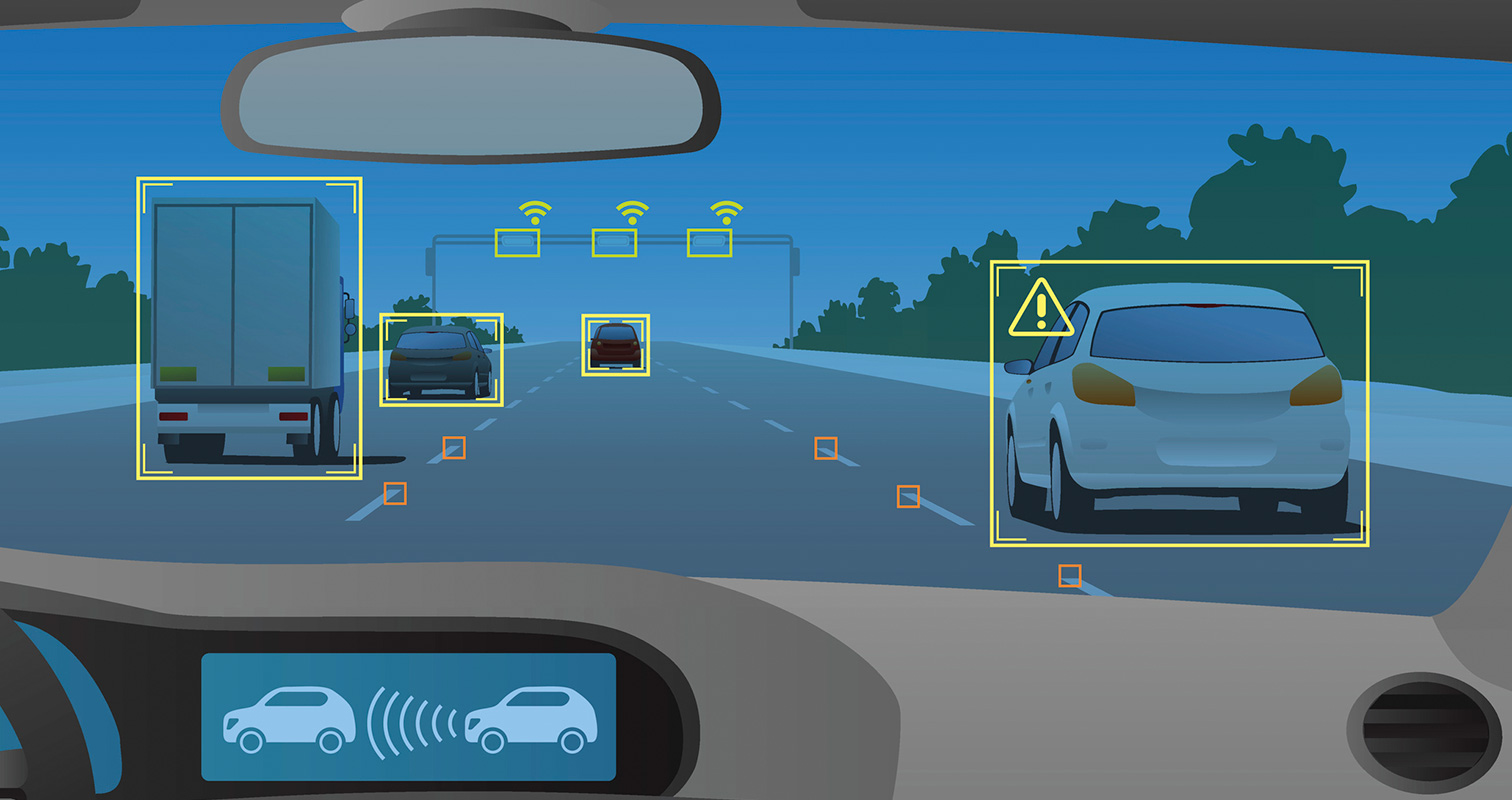

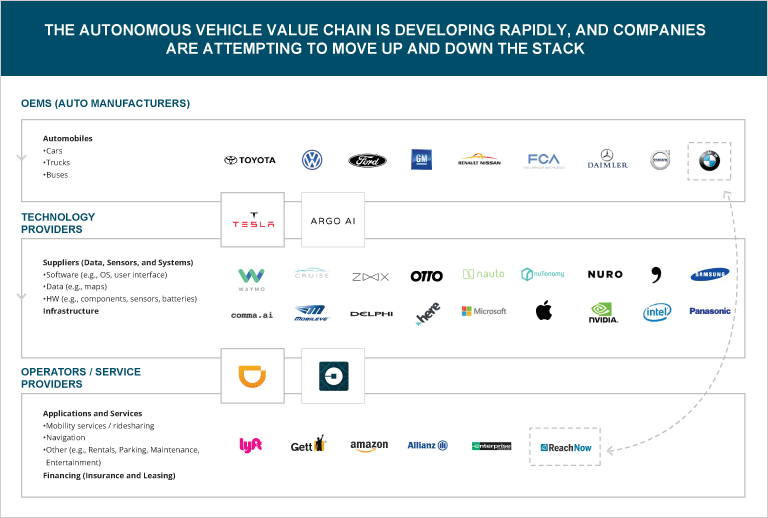

As automakers and technology companies begin shipping and operating autonomous vehicles, legislators, regulators, and transportation planners need to examine and consider how autonomous vehicles and other innovations such as car-sharing and ride-sharing can be integrated in large-scale transportation planning.

We published a report last year that proposed a vision for converting I-5 into an autonomous vehicle corridor at some point in the future. This year, we updated that report based on new market conditions to be more specific and more aggressive as the roll out for autonomous vehicles has sped up beyond our expectations.

Travel between Vancouver and Seattle can be long, tedious, and dangerous, but autonomous vehicles offer a solution to decrease traffic accidents (and resulting congestion), decrease travel times, and help travelers recover valuable productive time. These vehicles will likely to be part of ride-sharing fleets and other travel services that will benefit the entire population and lower the cost of transportation for everyone.

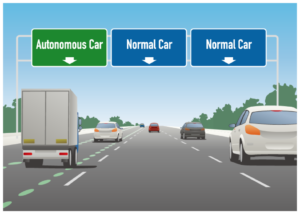

In our updated 2017 report we propose to convert I-5 between Vancouver and Seattle into an autonomous vehicle corridor by 2040. We suggest a phased in approach that begins with allowing autonomous vehicles to share the HOV lanes immediately and progresses to devoting two lanes to autonomous vehicles (which will create space for three autonomous vehicle lanes). Finally, by 2040, we believe all lanes of I-5 will be dedicated to autonomous vehicles during peak travel times.

By actively embracing and planning for a future with autonomous vehicles, Vancouver and Seattle can be an innovation leaders to cities and regions around the world, serving as an example for how to proactively and responsible incorporate this important cultural and technological change into their regional city and transportation planning.

![Asset2[1512x800]](https://www.madrona.com/wp-content/uploads/2016/09/Asset21512x800-300x159.jpeg)

![Asset1[1512x800]](https://www.madrona.com/wp-content/uploads/2016/09/Asset11512x800-300x159.jpeg)

![Asset3[1512x800] (1)](https://www.madrona.com/wp-content/uploads/2016/09/Asset31512x800-1-300x159.jpeg)