Every year in March, Madrona wraps up what happened in 2016 and we sit down with our investors to talk about our business – the business of finding and growing the next big Seattle companies. First and foremost, our strategy is to back the best entrepreneurs in the Pacific NW attacking the biggest markets. But we also overlay this with key themes and trends in the broader technology market. As part of our annual meeting we present our key investment themes for the year. Below is a snapshot of what we are focusing on:

Business and Enterprise Evolution to Cloud Native

The IT industry is in the early innings of its next massive shift. The transition to “cloud native” is as big or bigger as the move from PC to mainframes, the adoption of hypervisors, or the creation of public clouds. Cloud native at its core refers to applications or services built in the cloud that are container-packaged, dynamically scheduled, and microservices-oriented. Cloud Native enables all companies to take advantage of the application architectures that were once the province of Google or Facebook. Companies like Heptio and Shippable are at the forefront of disrupting how IT infrastructure has traditionally been managed with vastly increased agility, computing efficiency, real-time data, and speed. We firmly believe software that helps applications complete the journey from development on a cloud platform to deployment on different clouds, and running them at scale, will become the backbone of technology infrastructure going forward. As such, we are interested in meeting more companies that are making it easier to network, secure, monitor, attach storage, and build applications with container-based, microservice architectures.

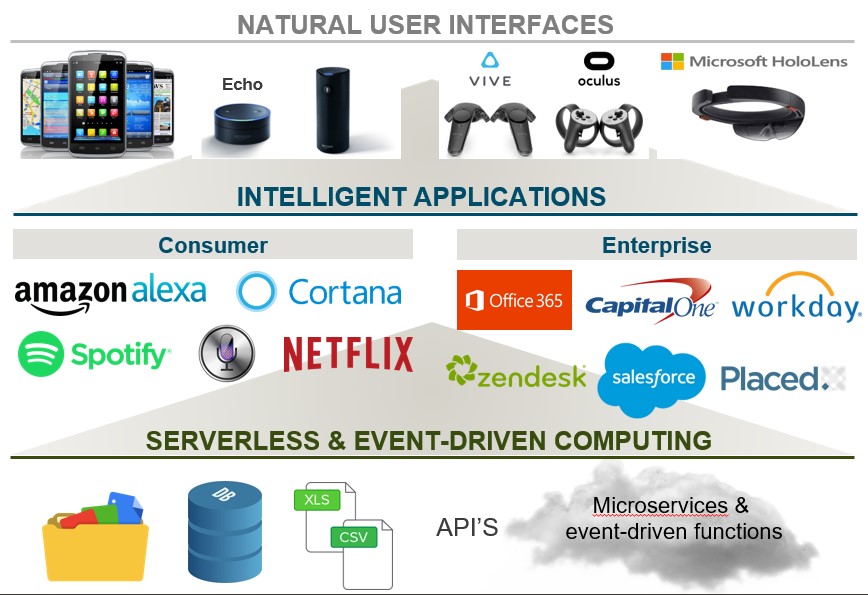

Intelligent Applications

Customers today demand their software deliver insights that are real-time, nimble, predictive, and prescriptive. To accomplish this, applications must continuously ingest data, increasingly using event-driven architectures, coupled with algorithm-powered data models and machine learning to deliver better service and novel, predictive recommendations. The new generation of intelligent applications will be “trained and predictive” in contrast to the old generation of software programs that were created to be “programmed and predictable.” We believe that intelligent applications which rely on proprietary datasets, event-driven cloud-based architectures, and intuitive multisense interfaces will unlock new business insights in real-time and disrupt current categories of software. Investments in intelligent app companies that leverage these trends will likely be our largest area of investment in coming years.

Voice and XR Interfaces for Businesses and Consumers

We believe the shift we are seeing for human computer interactions will be as fundamental as the mouse click was for replacing the command line or touch/text was for the rise of mobile computing. This shift will be as pertinent for the enterprise as it is for consumers, and in fact will serve to further blur the lines between productivity and social communication.

With voice, we are most excited by companies that can leverage existing platforms such as Alexa to create a tools layer, or build intelligent vertical end-service applications.

In the realm of XR (from VR to AR), we believe this is a long game. VR will not be an overnight phenomenon, but will play out over the next 5 years as mobile phones become VR capable and, particularly, as truly immersive VR headsets become less expensive and cumbersome. We are committed to this future and are particularly focused on VR/AR technologies that bring the major innovation of “presence” into a shared or social space, as well as “picks-and-shovels” technology that are needed by the XR community now to start the building process now even in advance of a largescale install base of headsets.

Vertical Market Applications that use proprietary data sets and ML/AI

As algorithms continue to become more accessible by way of access to open-source libraries and platforms such as the one our portfolio company, Algorithmia, provides, we believe that proprietary data will be the bottleneck for intelligent apps. Companies and products with ML at their core must figure out how to acquire, augment, and clean proprietary, workable data sets to train the machine learning models. We are excited about the companies with these data sets, as well as companies, such as Mighty AI, that help build these data sets or work with companies to help them leverage their proprietary data to deliver business value.

One area where we see this is happening is when ML/AI and proprietary data is applied to intelligent apps in vertical markets. Vertical market focus allows companies to amass rich data sets and domain expertise at a far faster pace than companies building software that tries to be omni-intelligent, providing both product and go-to-market advantage. Most industry verticals are ripe for this innovation, but several stand out including manufacturing, healthcare, insurance/financial services, energy, and food/agriculture.

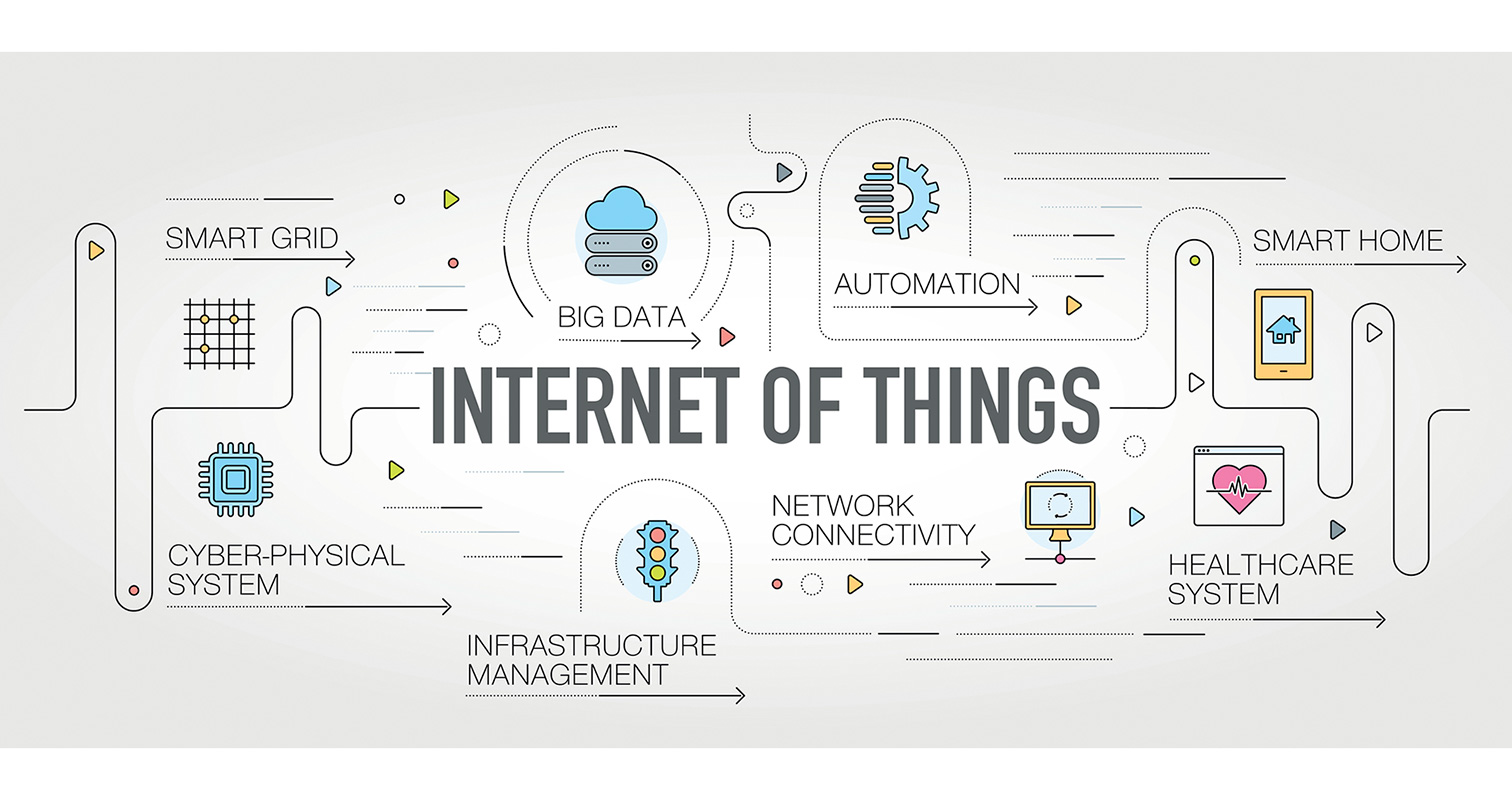

AI, IoT and Edge Computing

IoT can be an ambiguous term, but fundamentally we see the explosion of devices connected to the Internet creating an environment where enterprise decision-making and consumer quotidian life will be crucially dependent on real-time data processing, analytics, and shorter response times even in areas where connectivity may be inconsistent. Real time response is crucial to success and is difficult to meet in the centralized, cloud-based model of today. For example, instant communications between autonomous vehicles cannot afford to be dependent on internet access or the latency of connecting to a cloud server and back. Edge computing technologies hope to solve this by bringing the power of cloud computing to the source of where data is generated. We are particularly committed to companies building technologies that are focused on solving how to bring AI, deep learning, machine vision, speech recognition, and other compute-heavy services to resource-constrained and portable devices and improve communication between them.

Another facet of IoT where we continue to have investment interest is new vertical devices for consumer (home, vehicle, wearable, retail), healthcare, and industrial infrastructure (electrical grid, water, public safety), along with enabling supporting infrastructure. Opportunities persist for networking solutions that improve access, range, power, discoverability, cost, and flexibility of edge devices and systems management that provide enhanced security, control, and privacy.

Commerce Experiences that Bridge Digital to Physical

Retail is in a state of flux and technologies are disrupting traditional models in more ways than e-commerce. First, physical retail isn’t going away, but it has a fresh new look. 85% of shoppers say they prefer shopping in stores due to a variety of factors including seeing the product and the social aspect. This has led the new generation of web-native brands such as Indochino, Warby Parker, Glossier and Bonobos to open stores – but they are very different, carrying little physical inventory and geared towards intimacy with customers and helping find the right product for the buyer.

Second, the decreasing cost of IoT hardware technologies such as Impinj’s RFID, advancements in distributed computing, and intelligent software such as computer vision will fundamentally alter physical retail experiences. Experiments are already underway at Amazon Go where shoppers can pick what they want and casually stroll out without waiting in a check-out line.

Within e-commerce, vertically integrated, direct-to-consumer models remain viable and compelling. They bypass costly distribution channels and can build strong brands and intimate customer experiences like Dollar Shave Club, Blue Apron, or Stitch Fix. Marketplaces that leverage underutilized resources or assets; or the technology that underlies these marketplaces remain relevant and compelling particularly for the millennial generation that prioritize access over ownership.

Security and Data Privacy

While certain security categories have been massively over-funded, new investment opportunities continue to arise. Security and data privacy are areas of massive concern for businesses, particularly in the current macro environment. Internally, enterprises demand full visibility, remediation tools, and monitoring capabilities to guard against increasingly sophisticated attacks. Particularly vulnerable are companies that house massive amounts of customer data such as financial services, big retailers, healthcare, and the government. Externally, the collection and analysis of massive amounts of real-time consumer behavioral and personal data is the bread and butter of sales, marketing, and product efforts. But new privacy laws in the US and imminent from the EU are creating heightened awareness of both the control and security of this data. We continue to be interested in companies and technologies that take novel approaches to protecting consumer data and helping corporations and organizations protect their assets.

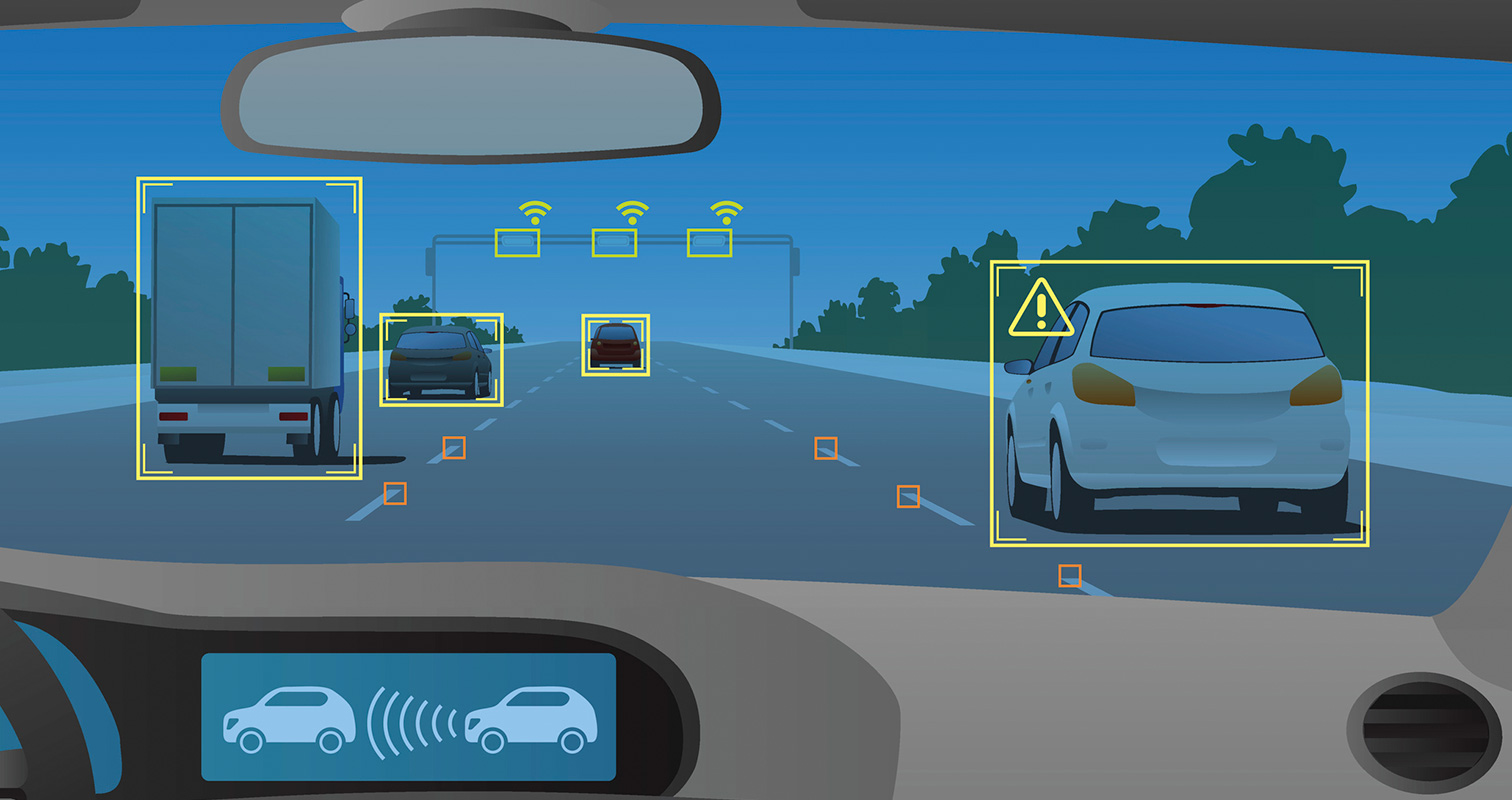

Technologies Supporting Autonomous Vehicles

Transportation technology is experiencing a massive disruption. Autonomous driving will be the biggest innovation in automobiles since the invention of the car, impacting suppliers, car makers, ridesharing, and everything in between. Lines are blurring between manufacturer and technology provider. We believe the value creation in AVs will, not surprisingly, shift to software, and the data that makes it intelligent. More innovation is required in areas such as computer vision and control systems. Important advancements also remain to be made in component technologies such as radar, cameras, and other sensors. Indeed, there are billions of edge cases due to construction, pedestrians, weather, and a murky regulatory environment that must be ironed out both at the technology and policy level before the promise of AV is a reality.

Additionally, the rise of AV could massively disrupt current modes of car ownership. Fleet and operations management software will become increasingly important as AV transportation-as-a-service becomes more and more tangible. Software and systems for other vehicles including drones, trucks, and ships will also be huge markets and create new investment opportunities.

Seattle and the PNW are emerging as thought leaders in the area of AV, and we believe a technology center of excellence as well, creating new investment opportunities. We are deeply interested in all the threads that go into this complex and massive shift in technology, the car industry and in social culture.

Well, there you have it – Madrona’s key investment themes for 2017. Thanks for reading. If you are working on a startup in any of these areas – we would love to talk to you. Please shoot any of us a note – our email addresses are on in our bios on our website.